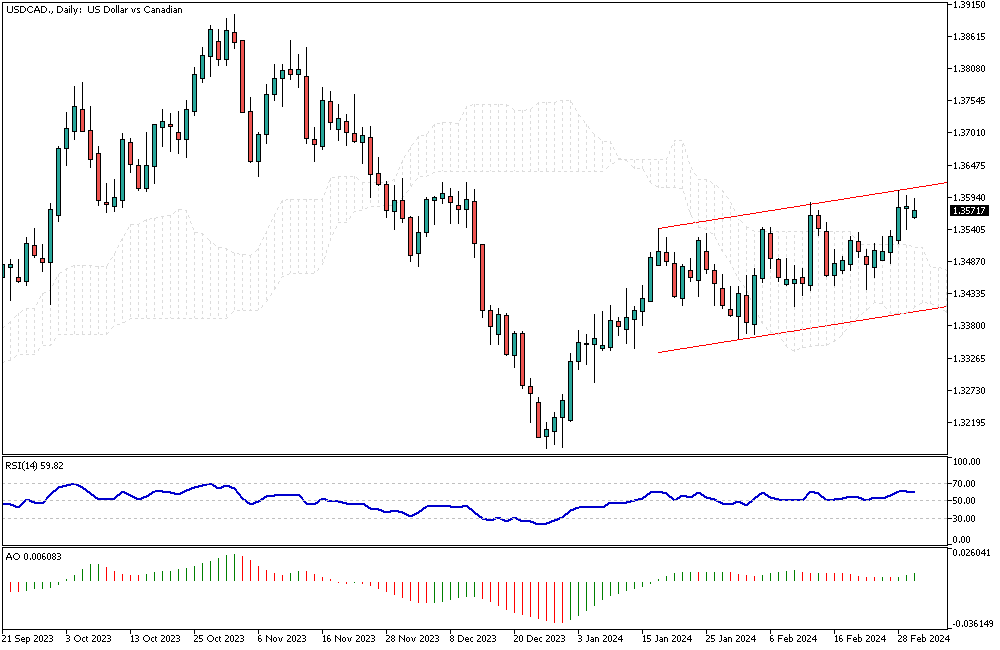

USDCAD Analysis – March-1-2024

USDCAD Analysis – The Canadian dollar has seen an upturn, moving past 1.355 against the US dollar, recovering from its nearly three-month nadir of 1.36 recorded on February 28th. This improvement is primarily attributed to the unexpectedly strong GDP data. The economy grew, registering a 1% annualized increase in the fourth quarter, higher than the anticipated 0.8%.

This growth indicates a resilient Canadian economy, providing the Bank of Canada with more leeway to deliberate on the timing and magnitude of potential interest rate cuts throughout the year.

Economic Resilience Supports Monetary Decisions

Canada’s latest economic figures suggest a rebound, with a notable adjustment in the third-quarter figures and a preliminary sharp increase in January. These positive developments reflect the economy’s durability, potentially influencing future monetary policy. The data gives the Bank of Canada an opportunity to assess the economic landscape more thoroughly before deciding on interest rate adjustments. This evaluation period is crucial as it helps formulate a strategy that aligns with the current economic momentum.

USDCAD Analysis: Strong Exports Enhance Currency Strength

The robust foreign demand for Canadian energy exports also bolsters the Canadian dollar’s recent recovery. This demand not only underscores the country’s economic strength but also encourages foreign exchange inflow, thereby supporting the currency’s value. The sustained interest in Canadian energy products abroad contributes significantly to the nation’s economic health, reflecting positively on the currency market.

This dynamic illustrates the interconnectedness of trade, currency value, and monetary policy in shaping Canada’s financial landscape.