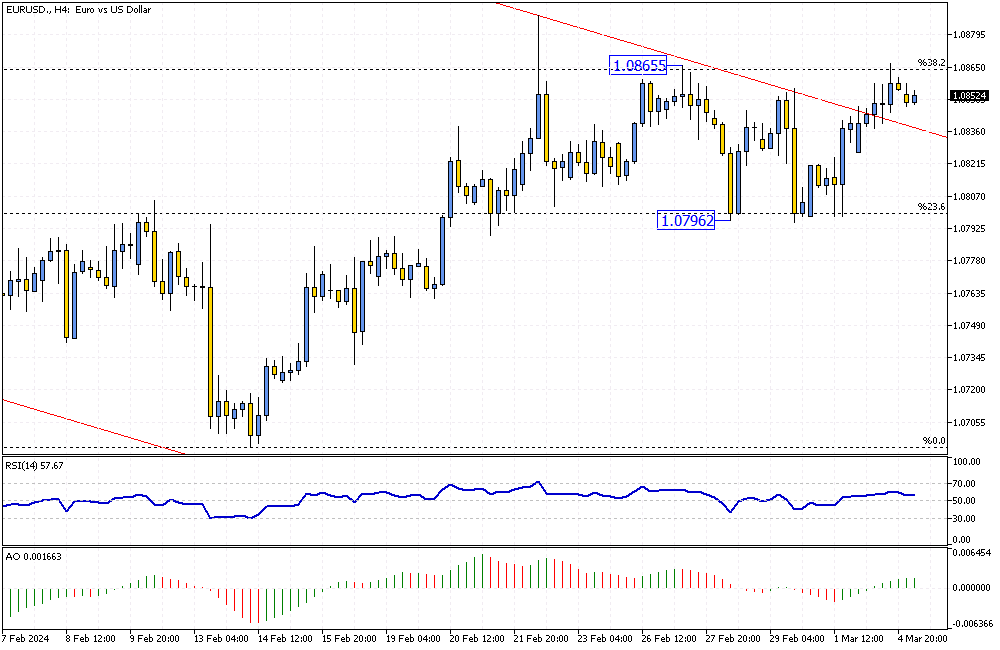

EURUSD Analysis – March-5-2024

EURUSD Analysis – The euro experienced a significant increase, reaching $1.085, its highest value since the beginning of February. This uptick occurred as market participants shifted their focus toward the European Central Bank’s (ECB) impending monetary policy meeting. Investors eagerly await this event to gain deeper insights into the bank’s future policy directions. The anticipation surrounding this meeting underscores the market’s keen interest in the ECB’s strategic decisions and their implications for the euro’s valuation.

ECB’s Monetary Strategy: A Focal Point for Traders

As the European Central Bank’s next meeting approaches, there is widespread expectation that interest rates will remain at their peak levels. However, the financial community is set to examine the ECB’s latest economic forecasts meticulously. Additionally, they are looking for any hints from President Christine Lagarde about when borrowing costs might be reduced. This careful analysis is driven by the desire to understand the ECB’s future monetary policy moves and their potential impact on the economy and currency value.

EURUSD Analysis: Inflation Trends and ECB’s Prudent Approach

Recent statistics have indicated a slowdown in the Eurozone’s inflation for the second month, registering at 2.6% in February. This rate slightly exceeded the projected 2.5%, suggesting a cautious yet optimistic economic outlook. Furthermore, the core inflation rate also decreased to 3.1%, higher than the expected 2.9%. These figures highlight the ECB’s conservative approach toward adjusting its monetary policy, reflecting a balanced response to fluctuating economic indicators while focusing on long-term stability.