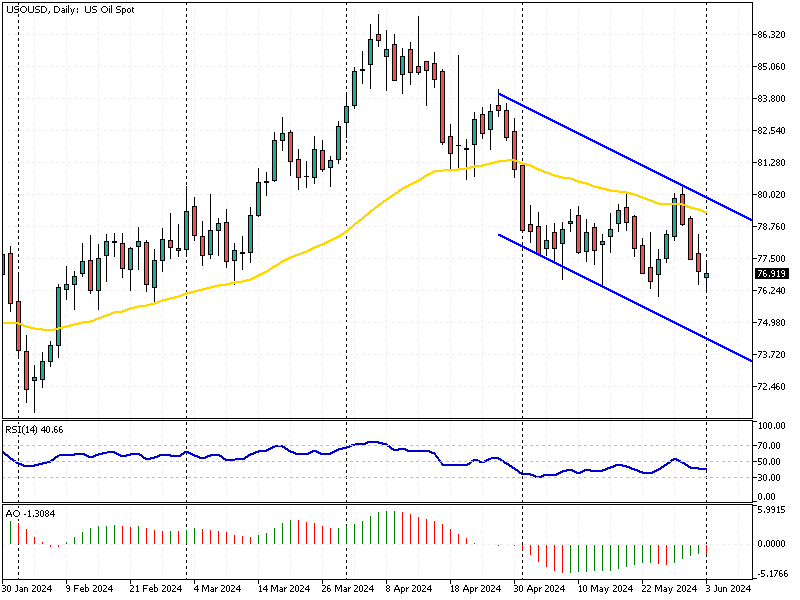

WTI Crude Oil Analysis – 3-June-2024

On Monday, WTI crude futures hovered around $77 per barrel, reflecting market uncertainty. This fluctuation follows OPEC+’s weekend decision to extend their collective output cuts into 2025.

The agreement includes voluntary reductions of 3.66 million barrels per day (bpd), initially set to end in 2024. Additionally, another set of cuts totaling 2.2 million bpd will continue until the end of the third quarter of this year.

WTI Crude Oil Analysis – 3-June-2024

OPEC+ Plans Gradual Oil Cut Reversal

Eight OPEC+ countries plan to gradually phase out these 2.2 million bpd cuts over a year, starting in October 2024 and concluding in September 2025. This move aims to stabilize the market, which has faced challenges recently.

Last month, oil prices dropped by about 6% due to concerns over demand. Market pressures have been heightened by fears that the US Federal Reserve will maintain high interest rates for longer, potentially slowing economic growth and reducing oil demand.

Conclusion

As OPEC+ tries to balance supply with uncertain demand, oil prices remain volatile. Investors and consumers should stay informed about these developments, as they can significantly impact the global economy and energy costs. Understanding these dynamics can help make informed decisions in this fluctuating market.