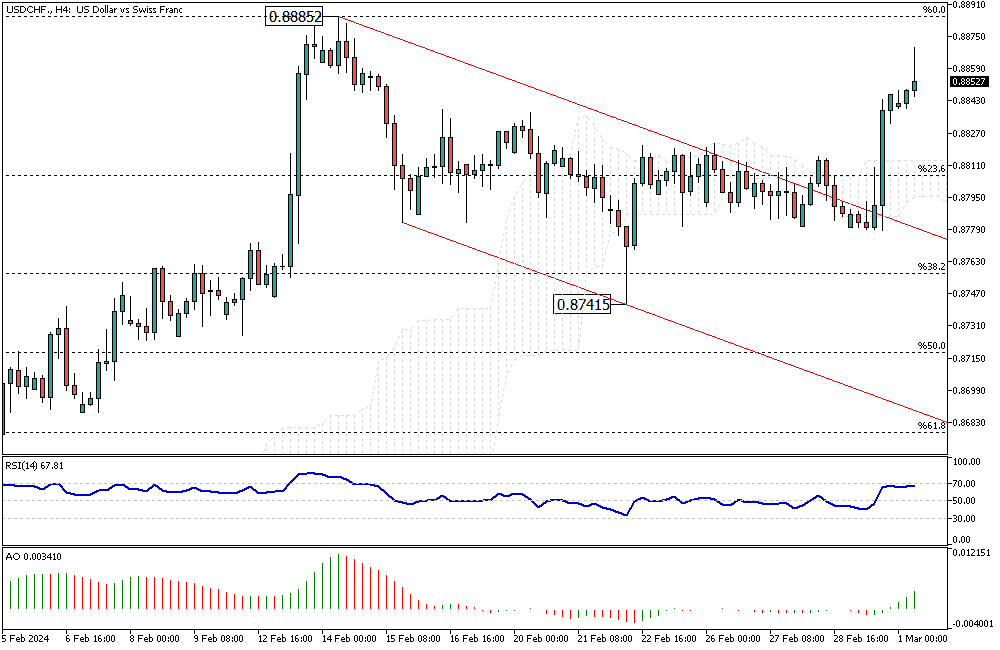

USDCHF Analysis – March-1-2024

USDCHF Analysis – The Swiss franc has maintained its value around the 0.88 mark against the US dollar, demonstrating resilience by bouncing back from its three-month low of 0.89 seen on February 13th. Fresh indications of solid economic progress within Switzerland support this recovery. Specifically, the nation’s GDP saw a 0.3% increase in the last quarter of the previous year, surpassing the anticipated minor growth.

This development aligns with the projections made by the Swiss National Bank (SNB), reinforcing that immediate interest rate reductions may not be necessary.

Positive Economic Indicators Reduce Rate Cut Pressure

Recent data has alleviated the pressure on the SNB to implement immediate rate cuts, thanks to Switzerland’s better-than-expected economic performance. Analysts had foreseen only a slight increase, yet the actual growth exceeded these predictions. This positive trend suggests a stable economic environment, which could influence future monetary policies.

However, the debate continues as more than half of market participants anticipate a rate cut by the central bank in March, influenced by the ongoing concerns over inflation rates.

USDCHF Analysis: Inflation Dynamics

Switzerland’s inflation scenario presents a complex picture for policymakers. In January, the inflation rate decreased to 1.3%, significantly under the predicted 1.7% and marking the lowest rate over two years. This decline occurred despite expectations for higher inflation following the reduction of electricity subsidies and adjustments in the value-added tax system.

The inflation rate has remained beneath the SNB’s 2% upper threshold for seven months, suggesting that the central bank might have more room to maneuver before reaching its inflation target. This situation underscores the SNB’s challenges in balancing economic growth with price stability.