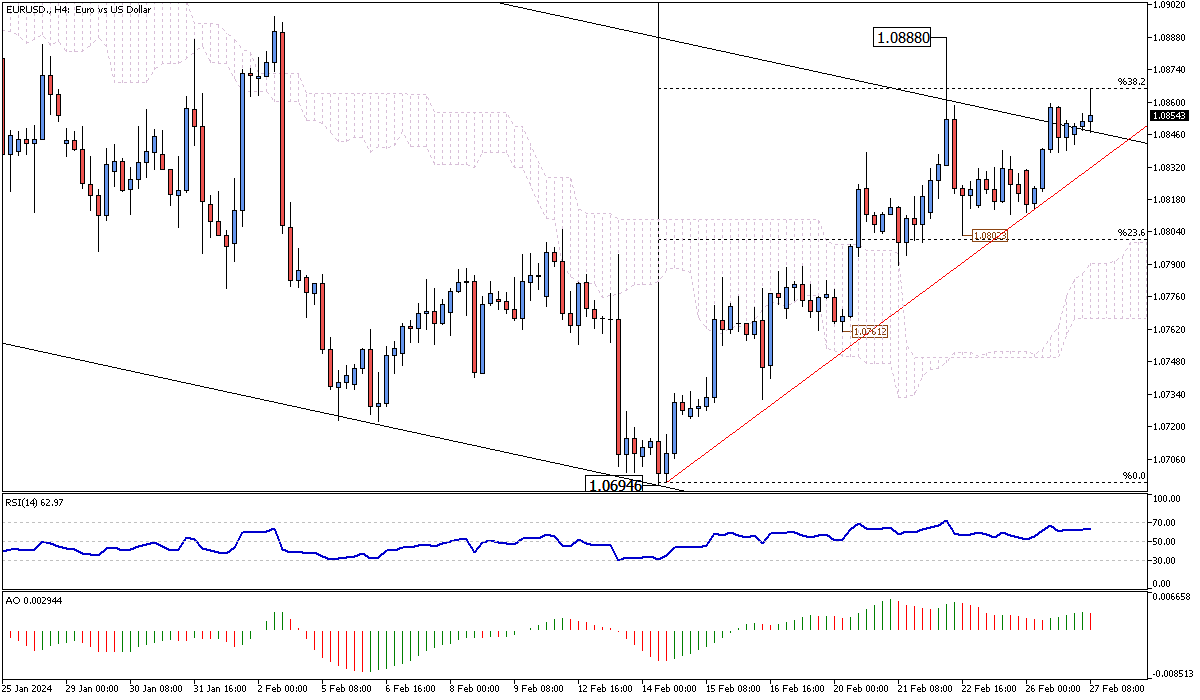

EURUSD Analysis – February-27-2024

FxNews – On Tuesday, February 27, the Euro and the US Dollar exchange rate experienced a slight uptick, from 1.0847 to 1.0854, marking a modest increase of 0.07%. This change indicates the subtle fluctuations that often characterize the forex market. Many factors, including economic indicators, geopolitical stability, and market sentiment, influence such movements. Understanding these trends is essential for investors and economists alike, as they reflect the underlying dynamics between two of the world’s major economies.

EURUSD Analysis: Historical Peaks and the Euro’s Journey

Historically, the EUR/USD pair has seen significant shifts, with its highest recorded value reaching 1.87 in July 1973. This peak represents a period of intense economic variables and market conditions that significantly impacted the exchange rates. It’s important to note that the Euro was officially introduced as a physical currency on January 1, 1999. Before this, the exchange rates were calculated through a synthetic methodology involving a weighted average of the currencies the Euro would later replace. This historical context is vital for understanding the long-term trends and forces shaping the EUR/USD exchange rate.

Synthetic Historical Analysis and Its Importance

Synthetic historical pricing is crucial when examining the value of the Euro before its official inception. Economists can construct a comprehensive picture of the Euro’s historical performance against the Dollar by analyzing the weighted average of the predecessor currencies. This method allows for a deeper understanding of the Euro’s strength and stability, providing insights into how past geopolitical and economic events have shaped current valuations. Such analyses are invaluable for predicting future movements and strategizing investment decisions in the volatile forex market.