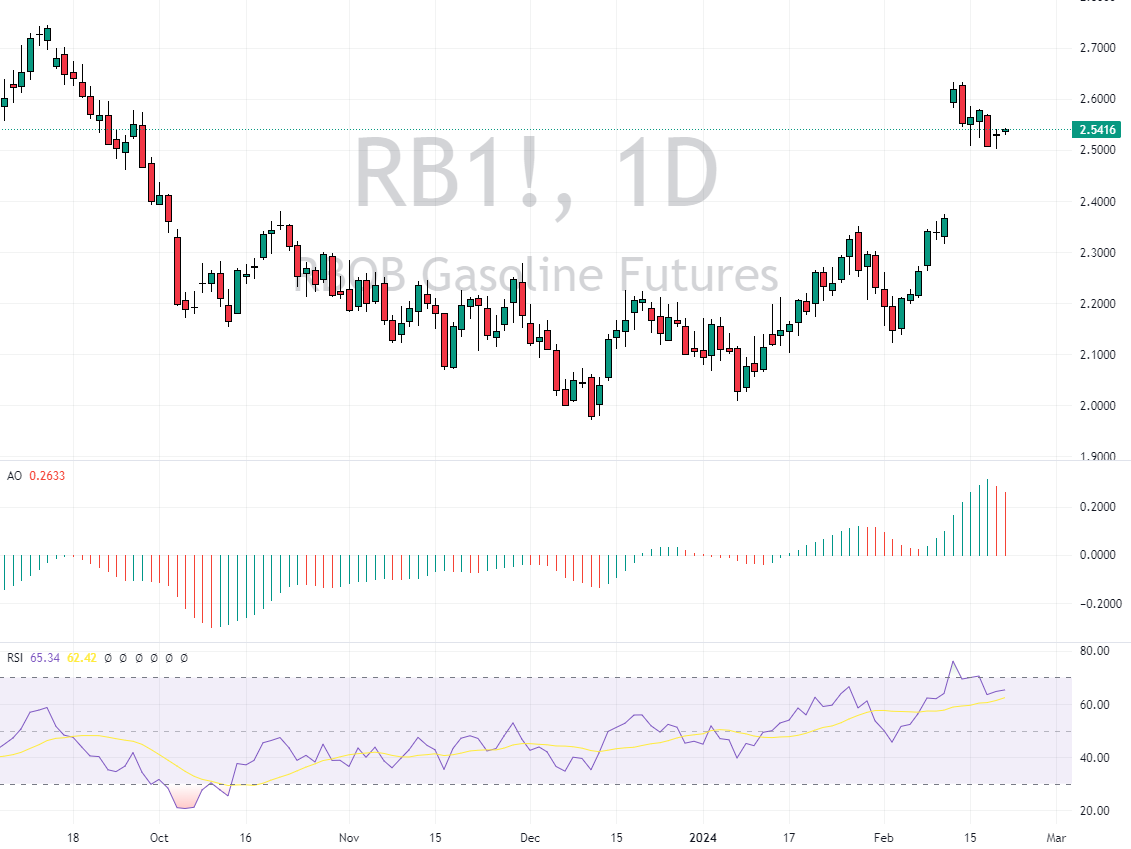

US Gasoline Analysis – February-22-2024

U.S. gasoline futures experienced a decline, reaching $2.3 per gallon, retreating from the peak of $2.4 seen on February 13th, which was the highest in over four months. This drop reflects decreased demand and lower costs for crude oil inputs. The change comes as industry watchers observe fluctuations in market dynamics, underlining the volatile nature of fuel prices influenced by domestic and international factors.

Surging Crude Stocks Amid Demand Shifts

Recent data from the Energy Information Administration (EIA) reveals a significant increase in U.S. crude oil stockpiles, surging by more than 12 million barrels for the week ending February 9th, far exceeding the anticipated 2.6 million barrels. This marked the most considerable rise in three months, indicating an unexpected shift in market supply dynamics.

Despite a notable decrease in gasoline reserves, a subsequent decline in gasoline products supplied has led to a tempered outlook for domestic demand, suggesting a potential recalibration of market expectations.

U.S. Gasoline Analysis

Geopolitical conflicts continue to cast a long shadow over global fuel markets. Tensions in the Middle East remain a persistent concern, influencing supply lines and potentially extending shipping routes, thereby affecting global market stability. Moreover, recent Ukrainian offensives targeting Russian refineries have further strained Russia’s export capabilities, exacerbating supply issues from one of the world’s key oil producers.

These events underscore the intricate connection between geopolitical events and energy markets, highlighting the importance of monitoring international developments for market participants.