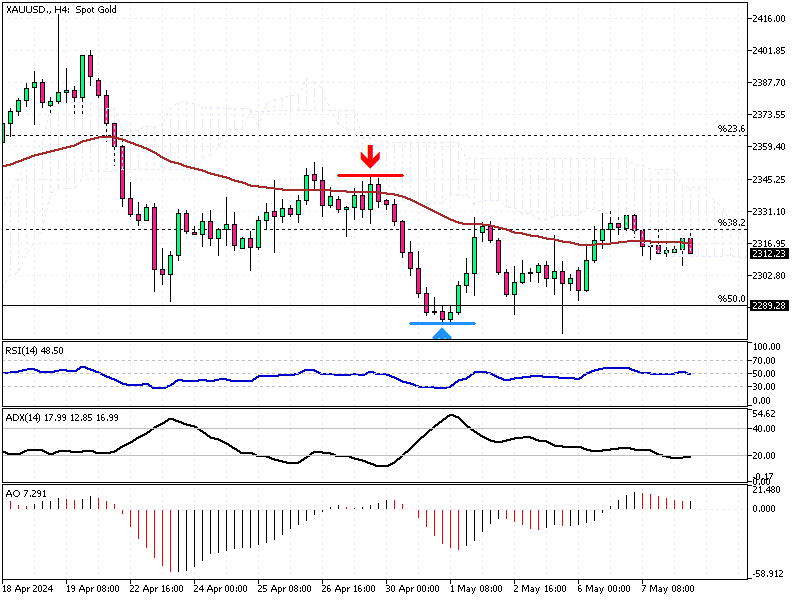

XAUUSD Analysis – China Buys More Gold

Gold prices remained stable at around $2,310 per ounce this Wednesday. Investors are keeping a close watch on upcoming statements from Federal Reserve officials. These statements are highly anticipated, as they could provide new insights into the potential for interest rate cuts later this year.

Federal Reserve’s Influence

Yesterday, Neel Kashkari, the President of the Minneapolis Federal Reserve, commented on the possibility of maintaining current borrowing costs due to stagnant inflation rates. This approach might extend through the year, influenced partly by a robust housing market.

According to the CME’s FedWatch Tool, there’s now a 65% probability that we might see a rate reduction as early as September. Such cuts could make gold, which does not yield interest, more attractive to investors.

Global Moves in Gold

On an international level, the People’s Bank of China increased its gold reserves by 60,000 troy ounces in April, continuing its buying streak for the 18th consecutive month. This action underscores the ongoing strategic importance of gold in national reserves.

Geopolitical Tensions

In other global news, the US is optimistic about reaching a ceasefire agreement between Israel and Hamas despite ongoing tensions. Yesterday, Israeli forces took control of the main border crossing in Rafah, adding a layer of complexity to the negotiations.