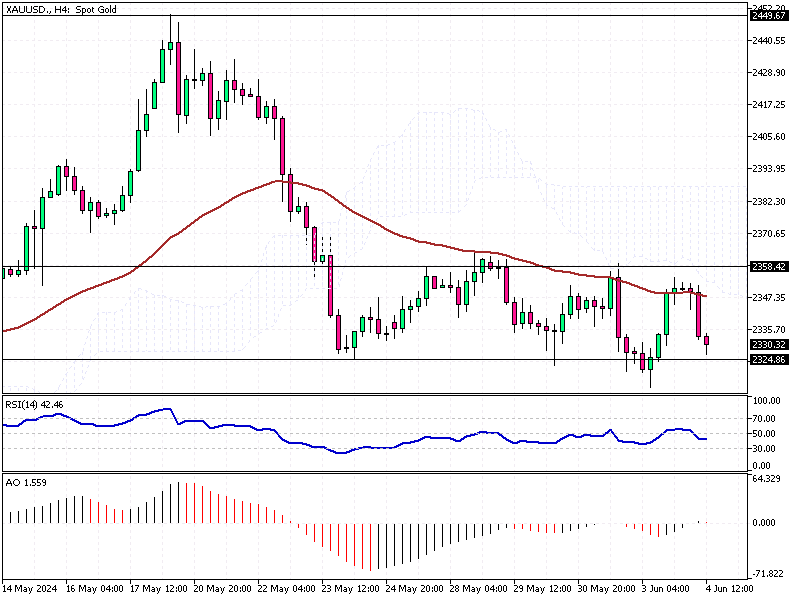

Gold Analysis – 4-June-2024

Gold prices stabilized around $2,340 per ounce on Tuesday, maintaining gains from the previous session. This stability is driven by growing expectations that major central banks will ease monetary policies soon.

Gold Analysis – 4-June-2024

US Manufacturing Slows in May

On Monday, US manufacturing data showed activity slowing for the second month in May. Additionally, construction spending fell unexpectedly in April, mainly due to a decline in non-residential activity. These factors have fueled speculation that the Federal Reserve may cut interest rates this year. According to the CME FedWatch tool, traders believe there’s a 60% chance of a rate cut in September.

European Central Bank to Cut Rates

Globally, the European Central Bank is anticipated to lower interest rates this week. Similarly, the Bank of Canada and the People’s Bank of China are expected to ease their policy conditions shortly.

Crucial US Jobs Data Expected

Investors are now keenly awaiting key US economic reports, including Wednesday’s ADP employment data and Friday’s non-farm payrolls. These reports will provide insights into the health of the US economy and help predict the Federal Reserve’s future policy moves.

Summary

Staying informed about these economic indicators and central bank decisions is crucial for wise investment choices in a dynamic market environment. Understanding these trends can help investors anticipate changes and adjust their strategies accordingly.