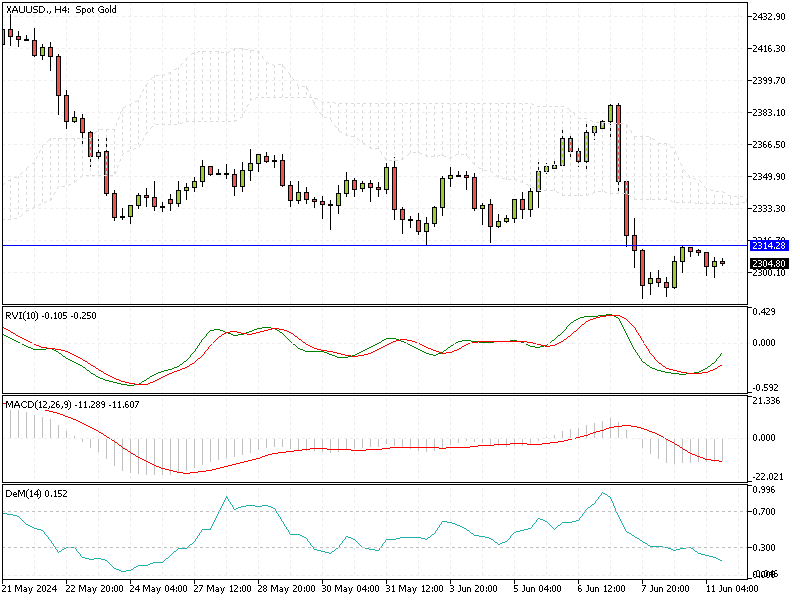

Gold Analysis – 11-June-2024

Gold prices dropped to around $2,300 per ounce on Tuesday, reaching a one-month low. This decline occurred as investors awaited critical U.S. inflation data and the Federal Reserve’s policy announcement, which was scheduled for later this week.

The gold market is susceptible to these events, as they provide insights into the future of interest rates.

Gold Analysis – 11-June-2024

Robust Payrolls Add Fed Rate Cut Uncertainty

The recent stronger-than-expected payroll report has added to the uncertainty. This report indicates a robust labor market, which could influence the Fed’s decisions on rate cuts. The market perceives a 50% chance of a rate cut in September, indicating a shift from earlier expectations of a more immediate easing.

China’s Gold Buying Halt Impacts Prices

China, a significant player in the gold market, has also influenced prices. The People’s Bank of China, the largest official buyer of gold, paused its purchases in May after 18 consecutive months of buying. This pause has added to the downward pressure on gold prices.

Macron’s Snap Election Response to Far-Right Gains

Meanwhile, political developments in Europe have added another layer of complexity. Gains by far-right parties in the European Parliament elections have increased political uncertainty. In response, French President Emmanuel Macron has called for a surprise snap legislative election.

Summary

These factors collectively highlight the interconnectedness of global economic and political events, influencing gold prices and investor sentiment. Staying informed will be crucial for making well-grounded investment decisions as we navigate these developments.