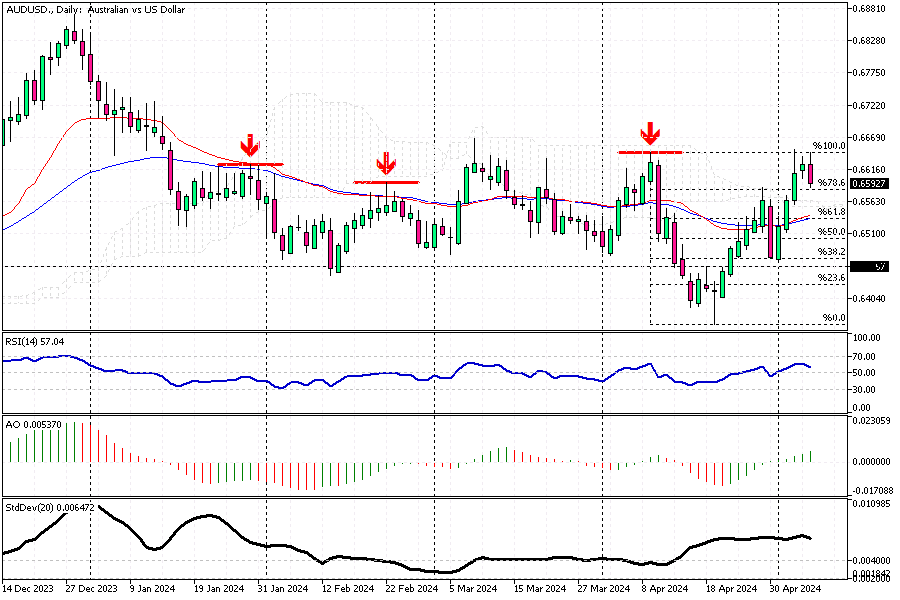

AUDUSD Analysis – Aussie Retreats Amid RBA Decision

The Australian dollar recently dropped to about $0.66 (AUDUSD), returning from its two-month high. This decline followed the Reserve Bank of Australia’s (RBA) decision to maintain the cash rate at 4.35%, a move that the markets anticipated. However, investors were left seeking a stronger, more hawkish signal from the RBA, which did not materialize.

Aussie Retreats Amid RBA Decision

Despite holding the interest rate steady for the fourth consecutive time since the last hike in November, the RBA expressed concerns over inflation dynamics. The central bank noted a pause in progress toward reducing inflation, which remains a key focus of its monetary policy. It also emphasized an open stance on future actions, indicating a flexible approach moving forward.

Inflation Trends and Implications

Australia’s inflation rate has slightly decreased, moving to 3.6% in the first quarter from 4.1% in the prior quarter. This marks the fifth consecutive quarter of deceleration. However, these figures still surpassed the forecasts, which had predicted a drop to 3.4%. Furthermore, contrary to expectations that inflation would stabilize, the monthly CPI indicator rose slightly to 3.5% in March from 3.4% in February.

This unexpected uptick suggests that inflationary pressures are still present, potentially influencing future decisions by the RBA.

Conclusion

These developments underscore the importance of closely monitoring RBA announcements and inflation indicators for forex traders and investors. The current economic signals suggest a cautious approach to trading the Australian dollar as the market assesses the potential for future rate adjustments based on inflation trends.