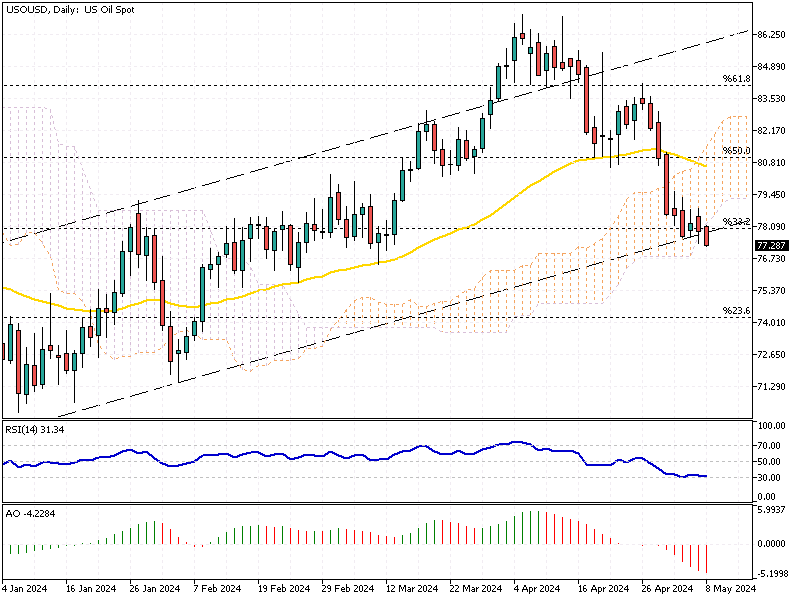

WTI Crude Oil Falls as OPEC+ Mulls Production Boost

WTI crude futures have dropped below $78 per barrel, reaching a near two-month low. This significant decline came after Alexander Novak, Russian Deputy Prime Minister, hinted that OPEC+ might consider a boost in crude production.

The consortium, including some of the world’s most influential oil producers, has scheduled a meeting on June 1 to discuss the production strategy for the latter half of the year. This potential increase in supply contributes to the pressure on oil prices.

Inventory Surprises and Global Demand

Contrary to expectations, U.S. crude inventories slightly increased last week, with stocks up by 0.509 million barrels against a forecasted decrease of 1.43 million. This unexpected rise adds another layer of complexity to the market dynamics, influencing traders’ strategies.

Additionally, all eyes are on China, the top crude importer, as its upcoming trade figures could provide crucial insights into global demand patterns.

OPEC+ Mulls Production Boost

The current supply agreement, which has cut 2.2 million barrels per day from the market, expires at the end of June, making the forthcoming OPEC+ meeting pivotal. Decisions made during this meeting will likely set the tone for the oil markets in the year’s second half. Investors and traders should stay tuned to these developments to navigate the volatile energy sector better.