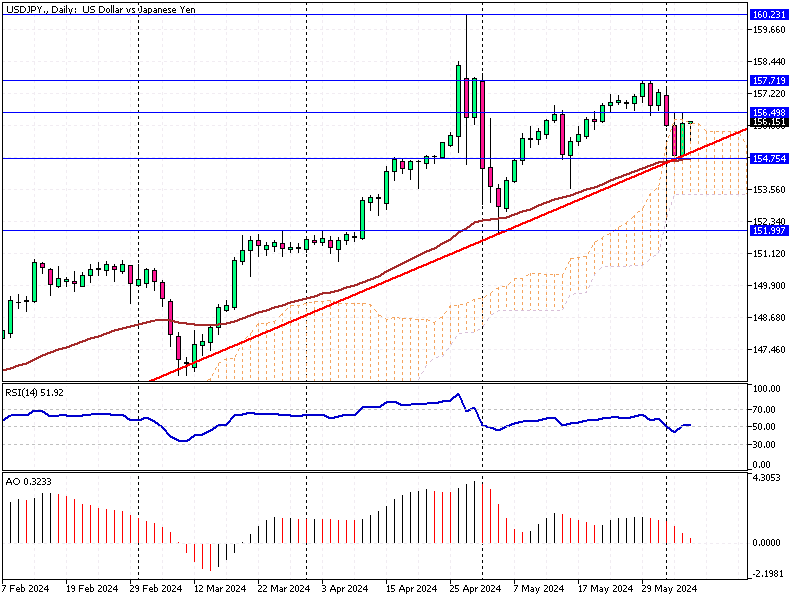

USDJPY Analysis – 6-June-2024

USD/JPY—The Japanese yen held steady at around 155.85 per dollar, as critical statements from Bank of Japan (BOJ) officials raised concerns about the country’s economic outlook. Toyoaki Nakamura, a BOJ board member, warned that Japan might not achieve its 2% inflation target next year if consumer spending weakens.

This caution dampened expectations for further interest rate hikes, a crucial tool for managing economic stability.

BOJ Eyes Yen and Inflation Risks

BOJ Deputy Governor Ryozo Himino emphasized the need for vigilance regarding the yen’s weakness and its impact on the economy and inflation. This highlights the central bank’s delicate balancing act between supporting growth and controlling inflation.

In a related development, Bloomberg reported that the BOJ might discuss reducing bond purchases at its upcoming policy meeting. This shift could signal a move towards tightening monetary policy, affecting the yen’s value and Japan’s economic conditions.

Yen Rallies Amid Global Uncertainty

Earlier in the week, the yen experienced a rally as global economic and political uncertainties increased demand for the currency as a haven. Additionally, the yen gained strength from a declining US dollar, driven by the Federal Reserve’s growing expectations of two rate cuts this year.

USDJPY Analysis – 6-June-2024