EURUSD Technical Analysis: Eying ECB Decision

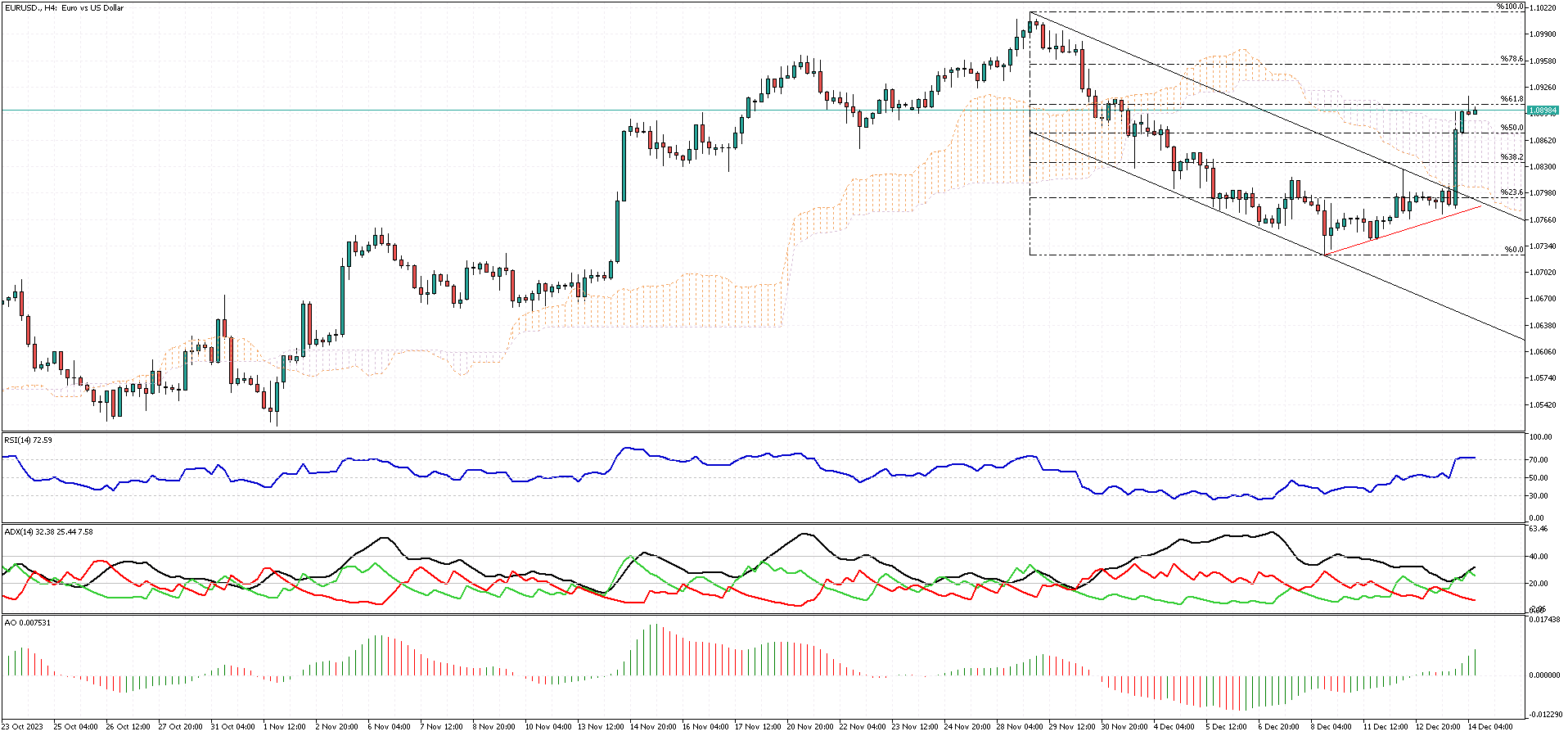

EURUSD technical analysis – The EURUSD currency pair recently gained substantial momentum, resulting in a close above the Ichimoku cloud. This pair formed an inverted hammer candlestick pattern near the 61.8% resistance level. At the same time, the RSI indicator entered the overbought zone. If the price stays below the 61.8% support level, we might see a decline to the 50% level, and potentially even to the 38.2% level.

Conversely, if the currency manages to break through the aforementioned resistance, this upward momentum could propel the price towards the 78.6% resistance level.

Euro Climbs as Fed Signals Potential Rate Cuts

The Euro rose for the second consecutive session, appreciating to above $1.085. This increase followed the Federal Reserve’s “dot plot” projections, which suggested three 25 basis point rate cuts next year. The Federal Open Market Committee (FOMC) members’ Summary of Economic Projections document showed an average expectation of a funds rate at 4.6% by the end of next year. This rate is significantly lower than the previously projected 5.1%.

Investors are now looking forward to the European Central Bank’s (ECB) interest rate decision tomorrow. The ECB is expected to maintain interest rates at record levels. Additionally, there may be indications that rate cuts are on the horizon, as recent data suggest a slowdown in economic activity and inflation within the bloc. Industrial production fell by 0.7% in October, a drop greater than the anticipated 0.3%. Furthermore, the annual inflation rate decreased to 2.4% in November 2023, marking its lowest point since July 2021.