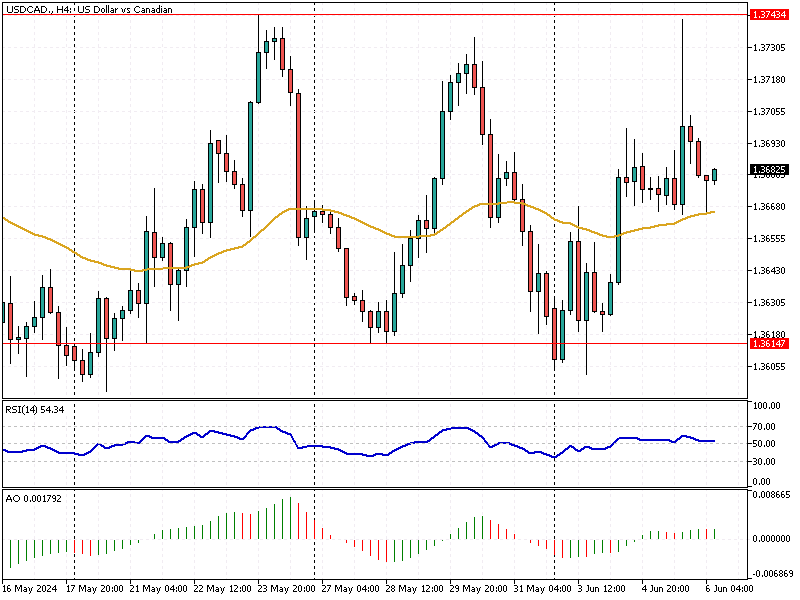

USDCAD Analysis – 6-June-2024

USD/CAD—In June, the Canadian dollar weakened beyond 1.37 per USD, hitting a one-month low. This shift followed the Bank of Canada’s (BoC) latest decision to cut its key interest rate by 25 basis points, bringing it down to 4.75%.

This move ended a streak of 11 months where interest rates were kept at their peak. The decision to lower rates was influenced by signs of disinflation, indicating that inflation is moving closer to the BoC’s target. As a result, the central bank opted for a less restrictive monetary policy.

USDCAD Analysis – 6-June-2024

Canada’s GDP Growth Slows in Q1

Furthermore, Canada’s economic data showed softer-than-expected GDP growth in the first quarter and a weaker labor market, contributing to the BoC’s rate cut. This year, the Canadian dollar has significantly depreciated against the US dollar.

This depreciation reflects concerns over slower economic growth in Canada and the growing interest rate gap between the BoC and the US Federal Reserve.

Central Bank Decisions Impact Finances

These developments highlight the importance of closely monitoring economic indicators and central bank decisions for investors and consumers. Understanding these factors can help make informed financial decisions, such as currency investments or evaluating the impact on borrowing costs.

Keeping an eye on broader economic trends can provide valuable insights into future market movements and financial stability.