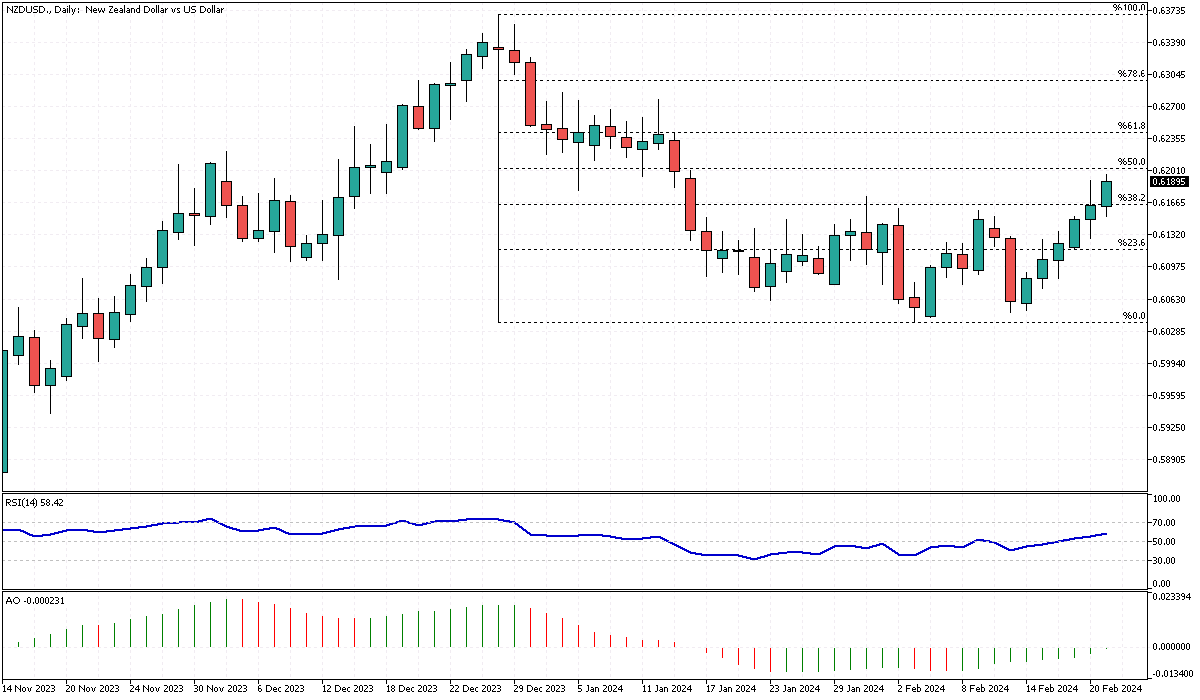

NZDUSD Analysis – February-21-2024

NZDUSD – The New Zealand dollar has climbed to near $0.62, reaching its highest point in the last five weeks. This surge is mainly due to the weakening of the US dollar, as market participants await the forthcoming details from the Federal Reserve’s recent policy review with bated breath. The anticipation around these minutes is stirring caution among investors, reflecting the global financial community’s scrutiny of US monetary policy directions.

NZDUSD Analysis: RBNZ’s Cautious Stance on Monetary Tightening

Adrian Orr, the Governor of the Reserve Bank of New Zealand, recently highlighted the ongoing challenges in managing core inflation, which remains a focal point for the country’s economic policy. While he emphasizes the necessity of continued efforts to reduce inflation, he also signals a cautious approach to avoid excessive tightening that could harm the economy. This delicate balance has led to a shift in market expectations, with reduced predictions for immediate rate hikes by the RBNZ.

The likelihood of increased rates this month has diminished, and market confidence in another hike within the year has fallen below 50%.

Impact of Monetary Policy on Inflation Trends

The latest economic indicators reveal a significant development: New Zealand’s inflation expectations have fallen to their lowest in over two years for the initial quarter. This trend suggests that the Reserve Bank’s prior rate increases have effectively moderated the previously soaring prices. This decrease in inflation expectations is a vital sign that the country’s monetary policies are making headway in controlling price levels, providing a more stable economic environment.

The effectiveness of past rate hikes is now reflected in moderated price growth, offering a more straightforward path for future monetary strategies.