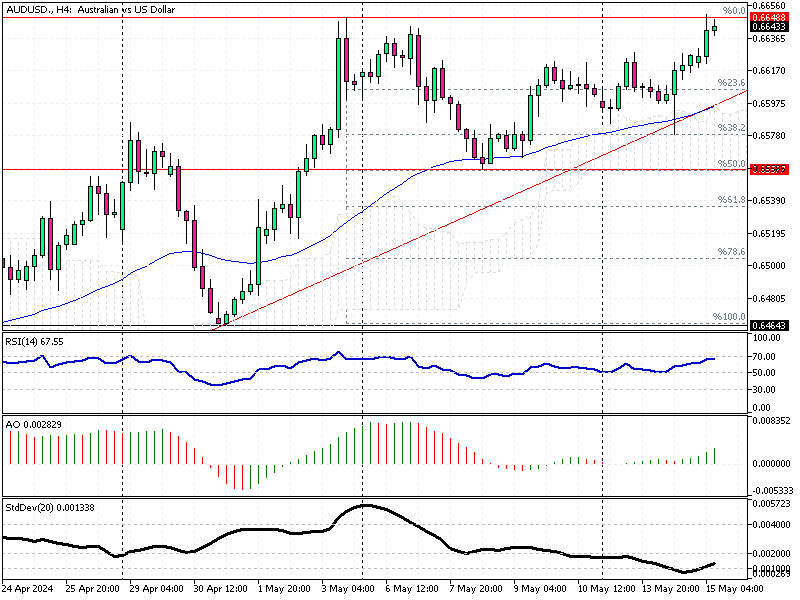

AUDUSD Analysis – Wage Growth Slows in Australia

The Australian dollar climbed above $0.664 (AUDUSD), reaching its highest point in two months. This surge happened as the US dollar weakened ahead of a critical US inflation report. Many traders expect the Federal Reserve to cut interest rates later this year.

Wage Growth Slows in Australia

Bloomberg—In Australia, the first quarter showed a surprising slowdown in wage growth. This data supports the view that the Reserve Bank of Australia (RBA) might adopt a more cautious approach to monetary policy. Slower wage growth usually means less inflation pressure, giving the RBA room to keep interest rates lower.

Government’s Budget Focuses on Inflation

This week’s annual budget from the Australian government highlighted efforts to reduce inflation and lower living costs. The government plans to spend billions on cutting energy bills and rent while also reducing income taxes. Treasurer Jim Chalmers predicted that the current inflation rate of 3.6% could drop to the RBA’s target range of 2-3% by the end of the year.

Implications for Interest Rates

If inflation does decrease as expected, the RBA might cut interest rates sooner than traders had anticipated. This would likely continue to support the Australian dollar’s strength. For forex traders, keeping an eye on domestic economic data and US inflation trends will be crucial for making informed decisions.