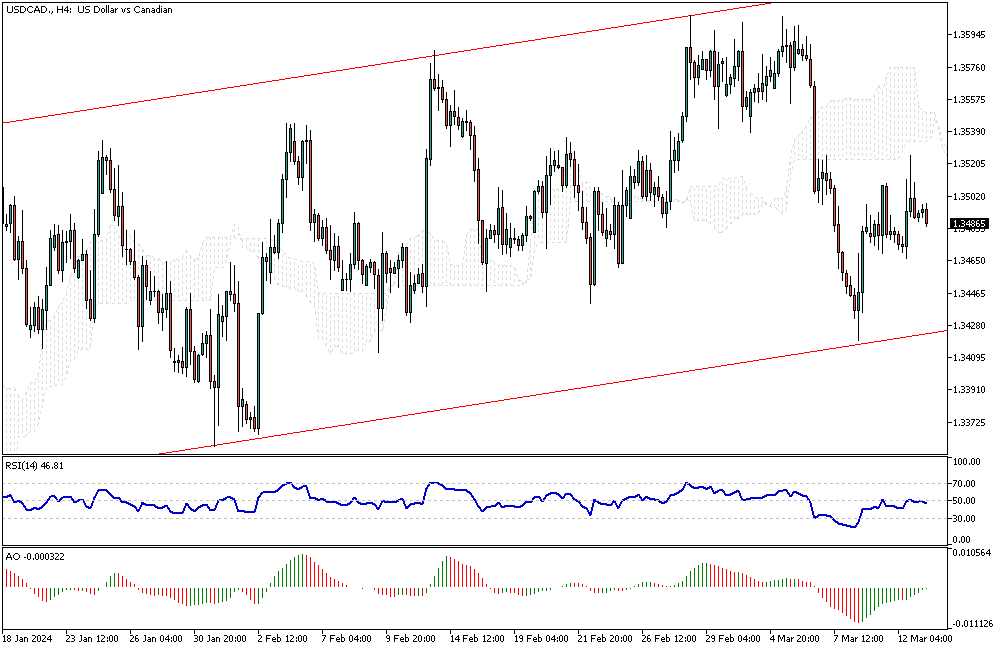

USDCAD Analysis – March-13-2024

USDCAD Analysis – Recently, the value of the Canadian dollar fell slightly, hovering around 1.35 per USD. This drop followed after the currency hit a one-month peak at 1.345 USD on March 7th. The dip came as the US dollar started to strengthen.

The US Federal Reserve’s decision on interest rates during the March 19-20 meeting is essential, with many predicting no change and potential cuts in June. This speculation is based on surprising data about consumer prices, which could further influence the Canadian dollar’s value.

Economic Factors Influencing Exchange Rates

Inflation rates have sparked some interest. The overall inflation rate rose to 3.2%, slightly higher than expected. However, the core inflation, which excludes certain items like food and energy, dropped slightly to 3.8% from 3.9%. Despite this slight drop, it’s still above the predicted 3.7%.

On the home front, the unemployment rate in Canada reached 5.8% in February, as expected. Surprisingly, the Canadian economy added 42,000 jobs, showing a solid job market. The Bank of Canada’s tight monetary policy controls how much the Canadian dollar’s value decreases, ensuring currency stability.

The Outlook for the Canadian Dollar

The situation with the Canadian dollar is tied to both local and international economic conditions. Even though the Canadian job market is doing well, the dollar’s value is significantly influenced by the strong US dollar and the global economic outlook. The Bank of Canada has some tough decisions to balance growth and control inflation.

The bank’s actions will be crucial in determining the future direction of the Canadian dollar’s value. As we move forward, monitoring these economic indicators, both local and global, will be essential for understanding potential changes in the currency’s strength.