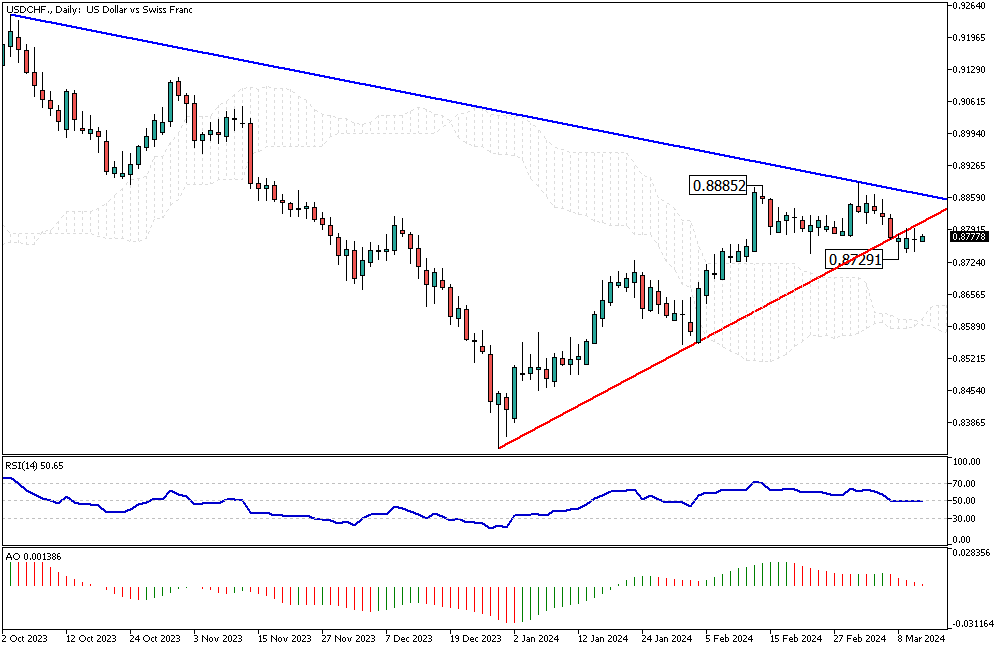

USDCHF Analysis – March-13-2024

USDCHF Analysis – The Swiss franc, a symbol of stability, is holding its ground at around 0.88 against the US dollar. It’s bouncing back from its lowest point in three months, which was 0.89 on February 13th. This recovery is a testament to the robust signs of economic health. Switzerland’s economy, defying expectations, grew by 0.3% in the last quarter of the year.

This growth was more than people anticipated, including the experts and the Swiss National Bank. As a result, the bank is feeling less pressure to lower interest rates soon.

Swiss Economic Growth and Inflation Trends

The Swiss economy is on a positive trajectory, signaling that lower interest rates might not be needed immediately. However, the pace of price increases remains moderate. Over half of the experts believe the central bank might reduce interest rates in March.

In January, the inflation rate was a mere 1.3%, significantly lower than the anticipated 1.7%. This is the smallest increase over two years, and the price rise has been below the 2% limit set by the Swiss National Bank for the seventh consecutive month.

Factors Affecting Swiss Inflation and Monetary Policy

Contrary to expectations, inflation in Switzerland has decelerated. This occurs as the country withdraws support for electricity costs and adjusts the additional taxes on goods and services. Despite these anticipated pressures, the drop in inflation has been substantial.

Consequently, there’s a high likelihood that the Swiss National Bank will cut interest rates in March. This development underscores how various economic factors can influence the bank’s decisions on interest rates.