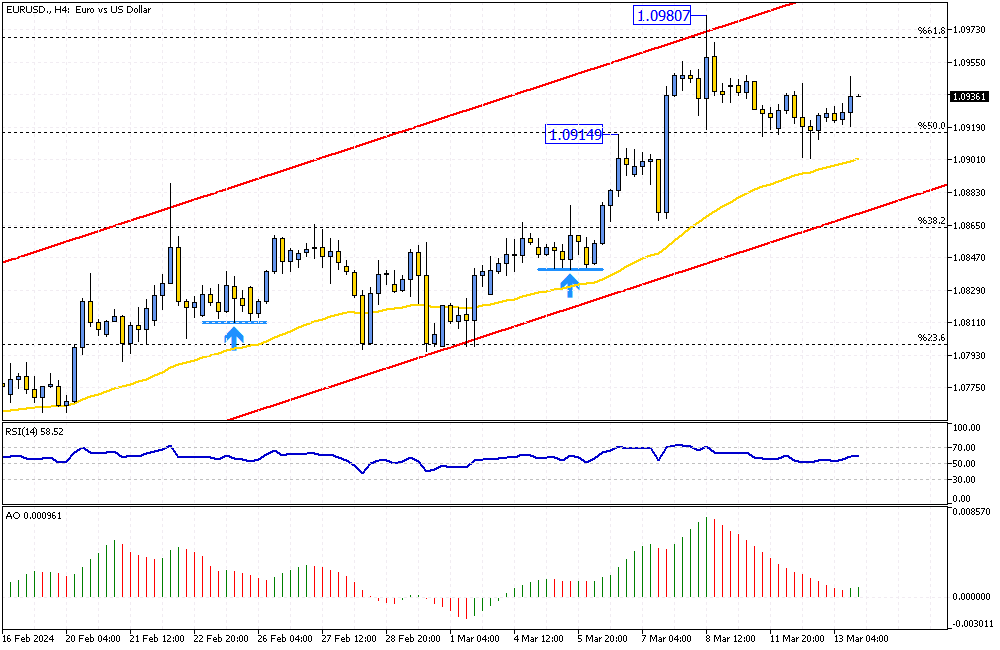

EURUSD Analysis – March-13-2024

EURUSD Analysis – Due to the weaker dollar, the euro is currently stable, valued at about $1.09. At the same time, market experts are looking closely at future financial policies. There’s a buzz around interest rates going down soon.

The US Federal Reserve (Fed) and the European Central Bank (ECB) hint that these cuts could start early in June. This is important for investing or saving money, as it affects market trends.

Anticipated Interest Rate Cuts and Economic Signals

Investors are leaning towards June for the expected interest rate reductions. The ECB also appears to agree with this timeline. The ECB is expected to reduce the cost of borrowing money by about one percent in 2024. This is big news because lower borrowing costs can encourage spending and investment.

However, in its recent meeting in March, the ECB decided not to change the current high rates. This decision was made even though there has been some success in reducing inflation, which is how fast prices for goods and services rise.

ECB’s Strategy on Inflation and Economic Growth

The ECB has a careful strategy. While it’s keeping borrowing costs high for now, it acknowledges the fight against high prices is working. Despite this, they’re cautious because of ongoing price increases and people’s wages are increasing. But there’s a silver lining. The ECB has lowered its expectations for inflation.

They now think prices will increase by 2.3% this year, dropping to 1.9% by 2025. This is crucial information for businesses and consumers as it helps them plan for the future. Lower inflation means the cost of living might not rise as quickly, which is good news for everyone’s wallets.