Geopolitical Tensions Impact on Gold Price

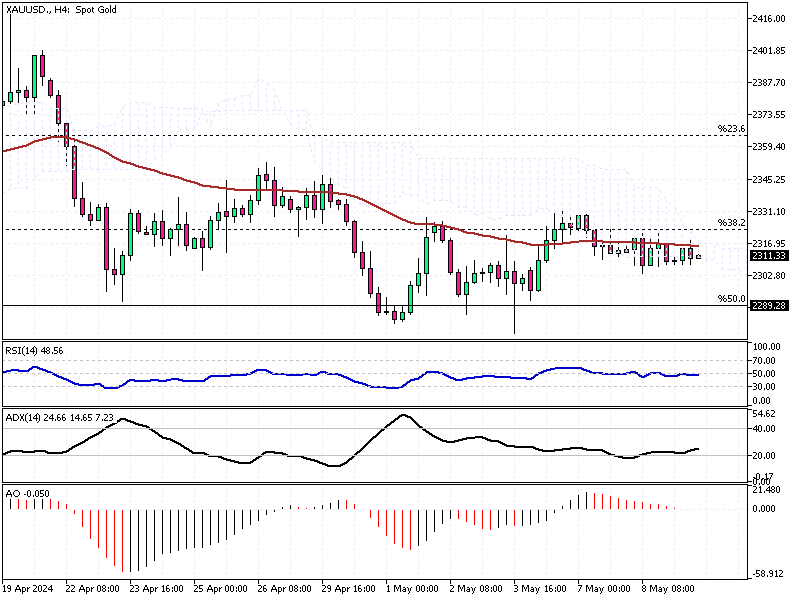

Gold prices remained stable at approximately $2,310 per ounce on Thursday. Market participants are keenly awaiting upcoming U.S. economic reports to glean insights into the possible timing of Federal Reserve rate cuts. The closely watched indicators include weekly jobless claims and the University of Michigan’s consumer sentiment index.

These data points are crucial as they provide clues about the overall economic health and consumer confidence in the U.S., which can influence the Fed’s monetary policy decisions.

Federal Reserve Signals and Market Reactions

Recent communications from Federal Reserve officials have kept investors on their toes. Susan Collins, President of the Federal Reserve Bank of Boston, highlighted the importance of cooling the U.S. economy to achieve the central bank’s 2% inflation target. This statement has influenced market expectations, with the CME’s FedWatch Tool now indicating a 66% likelihood of a rate cut by September.

A rate decrease could enhance the attractiveness of gold, which does not yield interest, as it becomes a more enticing investment than yield-bearing assets.

Geopolitical Tensions Impact on Gold Price

In addition to economic data, geopolitical developments are also shaping market dynamics. Recent statements from Hamas regarding the ongoing ceasefire negotiations in Gaza have introduced an element of uncertainty. Despite ongoing discussions in Cairo aimed at ending Israel’s seven-month offensive, Hamas has expressed reluctance to make further concessions.

This situation contributes to the complex interplay of factors forex traders must consider when assessing risk and making investment decisions.