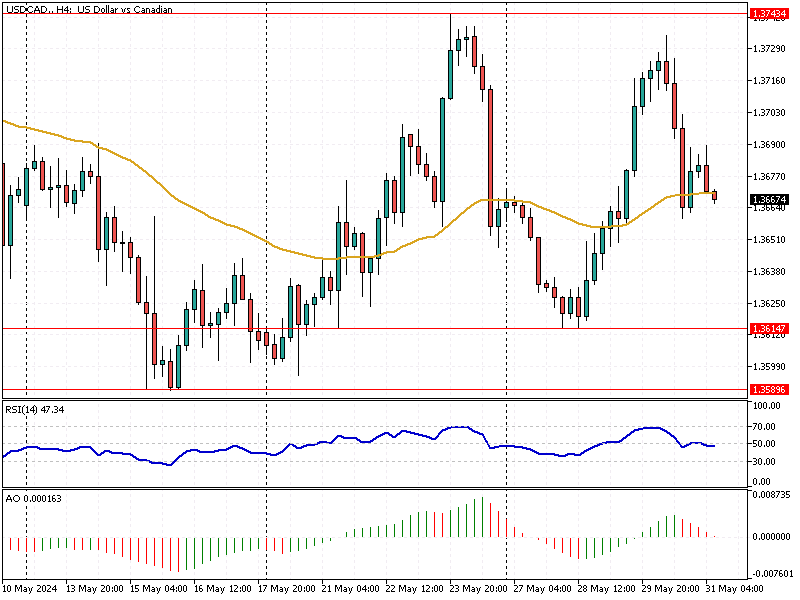

USDCAD Analysis – 31-May-2024

The Canadian dollar recently weakened beyond $1.37 (USD/CAD), approaching its lowest point of the month at 1.373, last seen on May 23rd. This decline is primarily due to the strengthening of the US dollar, influenced by recent statements from Minneapolis Fed President Kashkari. His hawkish remarks suggested a possible interest rate hike if inflation remains high, boosting the greenback.

USDCAD Analysis – 31-May-2024

Expectations for the Bank of Canada (BoC) also turned hawkish in Canada. April saw a significant rise in producer prices by 1.5%, following a 0.9% increase in March. This surge was nearly double the anticipated 0.8% rise, sparking concerns that inflation trends in Canada might mirror those in the US.

Despite these concerns, interest rate futures indicate a shift in market sentiment. Only 31% of the market anticipates a rate cut during the BoC’s June meeting, a notable decrease from over 55% the previous week. This data suggests that while inflation and rising producer prices influence expectations, the market remains cautious about potential rate cuts.

For those monitoring currency markets, these developments highlight the complex interplay between US and Canadian economic policies and their impact on the exchange rate. Understanding these trends can help make informed financial decisions.