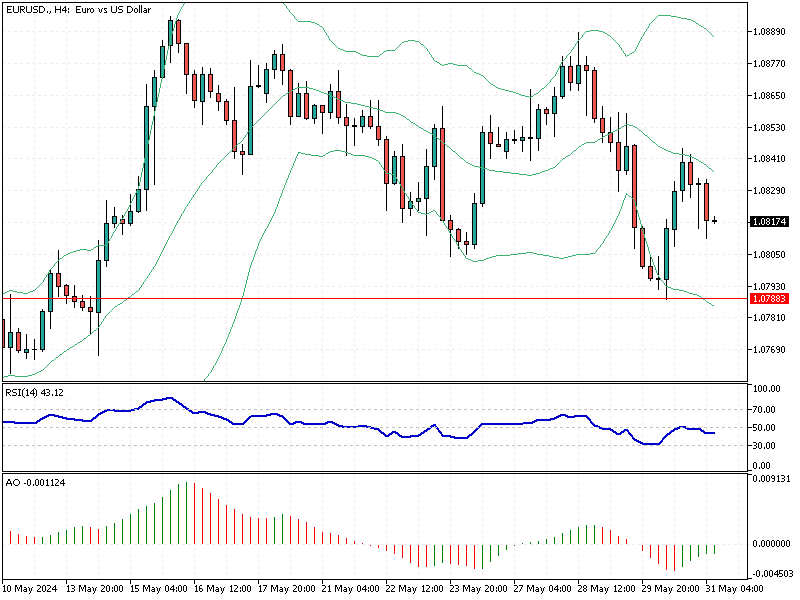

EURUSD Analysis – 31-May-2024

In the last week of May, the euro maintained its position at $1.086 (EUR/USD), just below the two-month high of $1.088 reached on May 15th. This stability comes as markets evaluate the European Central Bank’s (ECB) monetary policy outlook.

EURUSD Analysis – 31-May-2024

Germany’s EU-harmonized inflation gauge for May slightly exceeded expectations, rising to 2.8%. Although this increase wasn’t enough to derail the anticipated ECB rate cut next week, it did raise concerns.

The worry lies in the potential slowing of disinflation and the firmer growth signals seen in May’s Purchasing Managers’ Index (PMI) reports. These factors contribute to the uncertainty regarding the ECB’s ability to adopt a looser monetary policy in the third quarter.

On the other side of the Atlantic, hawkish remarks from Federal Reserve members have dampened hopes for a US rate cut by the third quarter. This stance has further influenced the euro-dollar exchange rate, adding pressure on the currency pair.

As investors and market participants navigate these developments, the steady euro reflects a broader sentiment of caution and a wait-and-see approach. The ECB’s upcoming decisions and the Fed’s stance will soon be critical in shaping the currency markets.