WTI Crude Oil Analysis – November-13-2023

Reuters — The week kicked off with a fresh wave of selloffs in the commodity market, causing the price of a barrel of Brent crude to drop to USD 80.65. Investors started trimming their long positions last Friday due to escalating uncertainties in the Middle East. This week, the market is keenly awaiting the release of monthly reports from the International Energy Agency and OPEC. These reports will provide updated evaluations of the oil sector, including potentially revised forecasts for supply and demand.

In addition, the market eagerly anticipates the latest US inflation statistics. As a key determinant of the Federal Reserve’s monetary policy, these figures hold significant implications for the oil market.

WTI Crude Oil Analysis: A Technical View

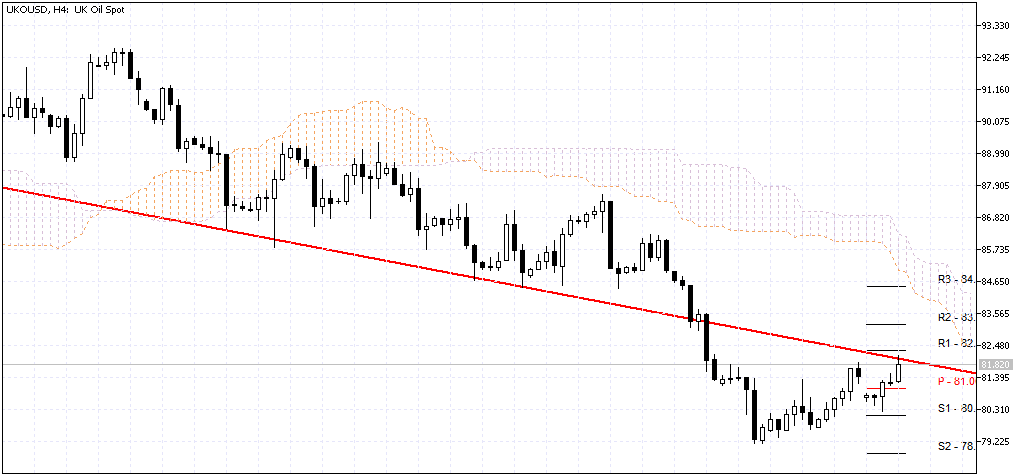

The Brent Crude Oil market is currently testing a significant resistance level, previously acting as support, at R1 ($82.3). This level is a crucial hurdle for market bulls. If the price remains below R1, we could see a potential decline towards the support levels of S1 and S2.

WTI Crude Oil Analysis – 4H Chart by Solid ECN

However, if the bulls stabilize the price above R1, we might witness a rise in Brent oil prices, potentially testing the R3 level at the $84 mark. It’s important to note that the overall trend for Brent oil remains bearish as long as the price is below the Ichimoku cloud.

Stay tuned for more updates on the Oil technical analysis and price movements.