USDCNH Analysis – Factors Affecting Asian Currencies

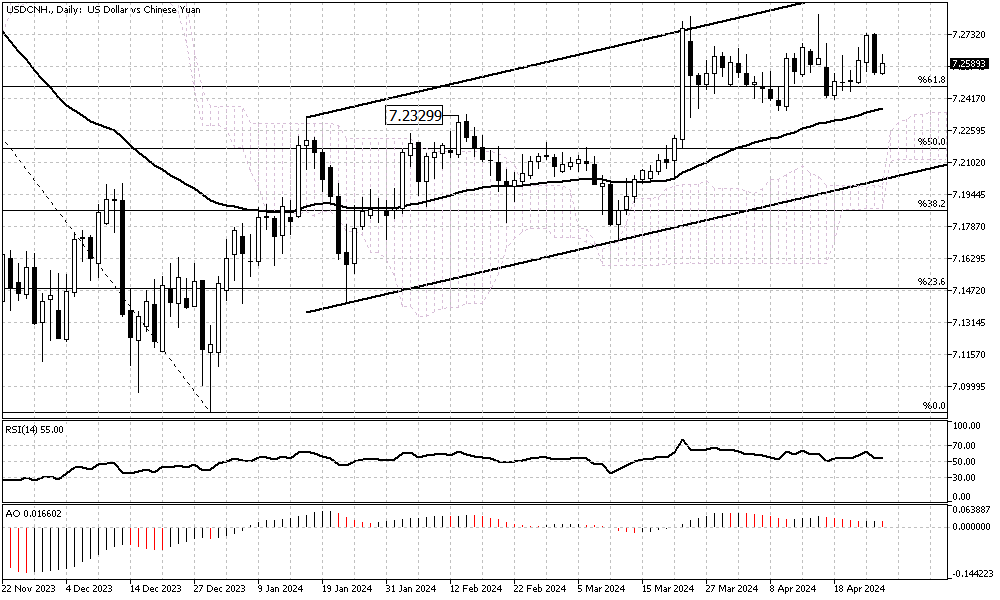

USDCNH Analysis – The offshore yuan has recently dipped to approximately 7.24 against the dollar, influenced by the weakening of the Japanese yen. This trend in the yen, which has fallen to about 156 per dollar—the weakest since May 1990—has exerted downward pressure on other Asian currencies, including the yuan. Such movements in currency values are often intertwined, reflecting the interconnected nature of global financial markets.

USDCNH Analysis – Factors Affecting Asian Currencies

The Bank of Japan has played a significant role in the yen’s decline by maintaining its interest rates at a low of 0-0.1%. This policy, aimed at stimulating economic growth, has had repercussions beyond Japan’s borders, affecting regional currency stability. Additionally, rising U.S. treasury yields and capital outflows from underperforming stock markets have compounded the pressure on the yuan.

Despite these challenges, the yuan has found some support through daily benchmark fixings and the intervention of state-owned banks, which strive to stabilize the currency amidst volatility.

Looking Ahead

Investors are now focusing on upcoming economic indicators from China, particularly the PMI data set to be released next week. This data is critical as it provides insights into the manufacturing sector’s health, a significant component of China’s economy. Depending on the outcomes, these figures could influence global market perceptions of China’s economic trajectory and further impact the yuan’s standing in the currency markets.