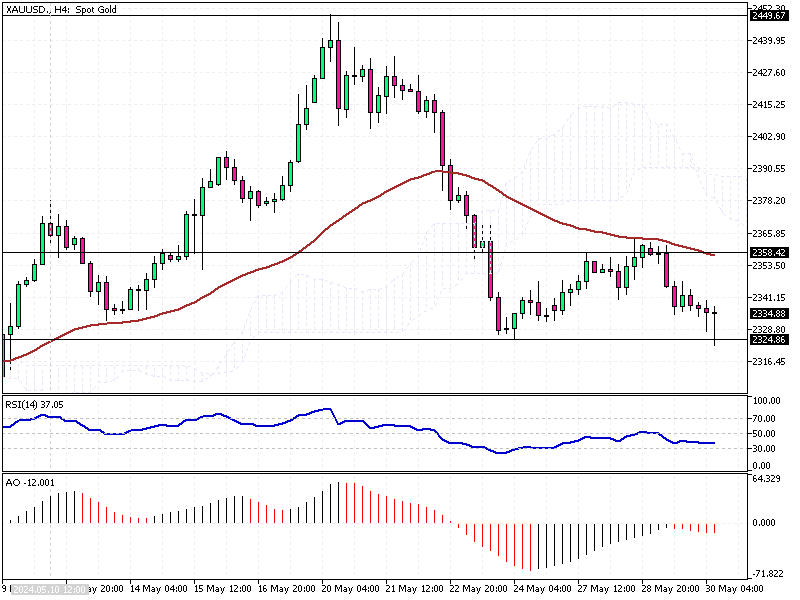

Gold Analysis – May-30-2024

Gold prices dropped to nearly $2,330 per ounce on Thursday, continuing to decline as US Treasury yields rose and dollar demand increased. Hawkish comments from Federal Reserve officials influenced this trend.

Gold Analysis – May-30-2024

Gold Analysis – May-30-2024

On Wednesday, Raphael Bostic, President of the Atlanta Fed, stated that achieving the Fed’s 2% inflation target is not guaranteed. He emphasized that price increases are still widespread. This followed remarks from Minneapolis Fed President Neel Kashkari, who suggested delaying rate cuts until significant progress in lowering inflation. Kashkari also hinted that further rate hikes could be considered if inflation does not decrease.

Investors are now looking forward to the second estimate of GDP figures, due later today, and the critical US PCE inflation report on Friday. The PCE inflation report is the Fed’s preferred measure of inflation. Additionally, initial jobless claims for May 25 will be released, providing more insights into the Fed’s future policy decisions.

Conclusion

These economic indicators will be crucial for investors to understand the central bank’s stance on interest rates and inflation. The recent comments from Fed officials have already signaled a cautious approach, influencing market trends and affecting gold prices.

As the economic landscape evolves, staying informed about these updates is essential for making well-informed investment decisions.