UK Economic Recovery Shifts GBPUSD Trends

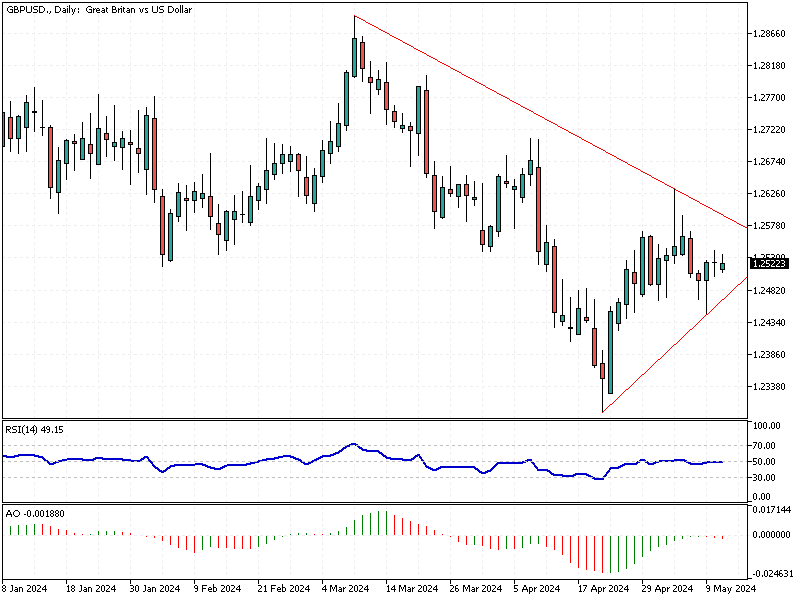

The British pound experienced a notable rise, followed by a partial decline, stabilizing around $1.25 (GBPUSD). This fluctuation was influenced by traders’ reactions to recent positive economic indicators and their potential impact on future monetary policies.

UK Economic Recovery Shifts GBPUSD Trends

The UK has successfully overcome a recession, with the economy expanding by 0.6% in the first quarter of 2024, surpassing the initial forecasts.

This development has led the Bank of England to adjust its annual growth projection from 0.25% to 0.5%. Such optimistic data suggests a recovering economic scenario, prompting investors to closely watch for shifts in the central bank’s strategies.

Bank of England’s Policy Stance

During its May session, the Bank of England maintained the interest rates, aligning with market anticipations. However, the meeting revealed a growing inclination towards reducing the rates, as evidenced by increased votes favoring a cut.

Governor Bailey hinted at potential rate reductions in the upcoming quarters, which might exceed current market predictions. This stance is crucial for traders, setting the tone for future monetary policy dynamics.

Market Reactions and Outlook

The trading community has slightly increased their expectations for a rate cut as early as June, though a 25 basis point reduction by August is already anticipated. These developments are critical for forex traders and investors as they strategize their positions in the volatile currency market.