Interest Rates and Their Impact on EURUSD

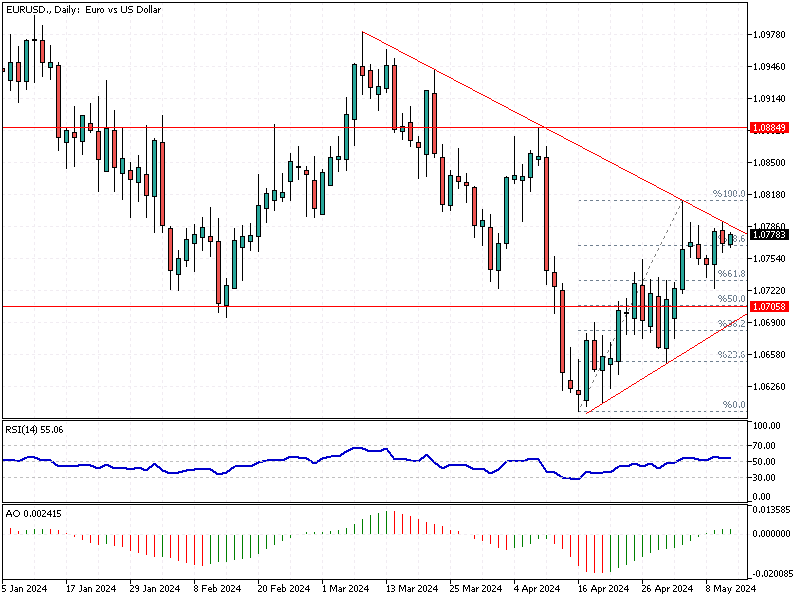

The Euro dropped to $1.076 (EURUSD) this past Friday, coming from a one-month high. This fall came as the US dollar gained strength following a new report. This report highlighted a significant drop in US consumer sentiment, marking a low not seen in the last six months.

The weakened sentiment is attributed to growing worries over inflation and uncertainties in the job market.

Interest Rates and Their Impact on EURUSD

Amid these economic pressures, US Federal Reserve officials are pushing for an increase in interest rates to manage persistent inflation. The European Central Bank (ECB) plans a different approach on the other side of the Atlantic. The ECB is expected to lower interest rates starting in June.

In contrast, the Federal Reserve might delay any rate cuts until September. Financial markets are forecasting a reduction of about 70 basis points in ECB rates and 45 basis points in Fed rates throughout the year.

Bank of England’s Stance

Meanwhile, the Bank of England has decided to keep the interest rates steady as of May. However, they have indicated that rate cuts could be on the horizon during the summer. This statement adds another layer of complexity for Forex traders and investors as they navigate these differing monetary policies across major economies.

Conclusion

As global economic indicators and central bank policies continue to evolve, Forex traders are advised to stay informed and agile. Understanding these dynamics can help make more strategic trading decisions in a volatile market.