USDCAD Analysis – Economic Indicators Shine

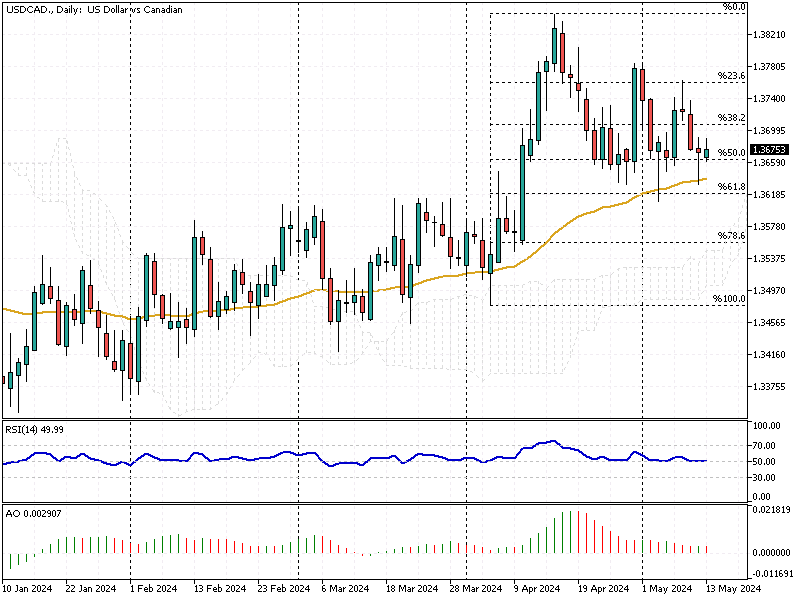

The Canadian dollar, often called the Loonie, has recently seen a notable increase in strength, approaching $1.367 (USDCAD) in May. This movement marks a one-month high, driven largely by positive economic indicators within Canada.

Recent reports have shown surprising resilience, particularly in the job market. April’s unemployment rate maintained a steady 6.1%. Additionally, a significant surge in net employment added an impressive 90,000 jobs, the largest gain over a year and far exceeding the modest expectations of an 18,000-job increase.

USDCAD Analysis – Economic Indicators Shine

Further boosting the Canadian dollar is the peak in business confidence, which reached its highest level in two years at 63. This figure surpassed forecasts and highlighted a robust sentiment in the private sector.

Such strong economic signals have reduced the urgency for immediate monetary intervention by the Bank of Canada, suggesting a stable outlook for the near term. However, it’s not all clear skies; April’s Purchasing Managers’ Index (PMI) indicated that manufacturing has been contracting for a year, presenting a potential hurdle to sustained economic optimism.

U.S. Factors and Forex Impact

The U.S. dollar has shown signs of weakness on the other side of the border, influenced by a less robust labor market. This situation has fueled speculation among traders about a potential rate cut by the Federal Reserve in September.

These dynamics between the Canadian and U.S. economies provide crucial insights for forex traders and investors. Monitoring these trends can help make informed decisions, especially in predicting currency movements and understanding broader economic impacts.