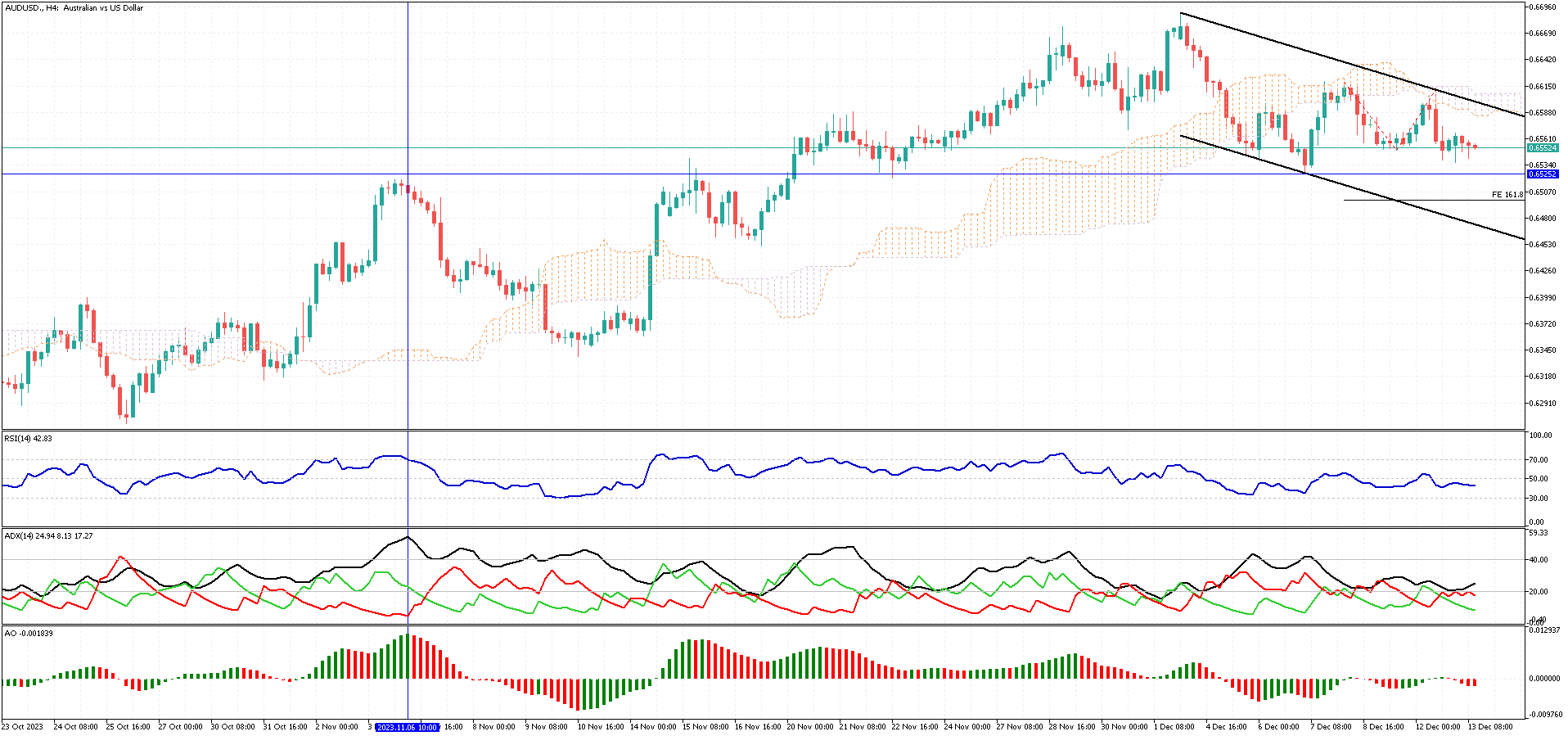

AUDUSD Analysis – December-13-2024

The Australian Dollar against the US Dollar (AUDUSD) is trading beneath the Ichimoku cloud. This movement below the cloud indicates that the previously bullish trend might be coming to an end. Despite this shift, the pair has not yet managed to fall below the high recorded in November, which stands at 0.6525. Following this, there was a noticeable surge in the AUDUSD price, leading to a second test of the cloud within this month.

Potential Market Trends

As the AUDUSD pair continues to move within what appears to be a bearish flag pattern, the bears might likely push the price below the 0.6525 support level. If this scenario plays out, the market may aim for the 161.8% Fibonacci support level, subsequently moving towards the lower boundary of the trading channel.

Bearish Outlook

On the flip side, as long as the AUDUSD pair remains below the Ichimoku cloud, the general market trend is expected to stay bearish. Traders should closely monitor these movements for signs of a shift in the market dynamics.

Fundamental View: Pressure on the AUD

Bloomberg – The Australian dollar is facing challenges, staying around $0.655. This situation arises as investors wait cautiously for interest rate decisions from key central banks. Adding to this, Michele Bullock, the Reserve Bank of Australia’s Governor, mentioned that they’re being careful with their monetary policy. They’re closely observing economic data, ensuring Australia keeps up in controlling global inflation.

Investors seem to think the Reserve Bank of Australia might stop increasing rates. They also believe that inflation in Australia might slow down compared to other big economies. Recent reports are not very optimistic. They show that Australian consumer confidence in 2023 had one of its worst years due to rising living costs and high-interest rates. In November, business confidence also fell sharply across various sectors.