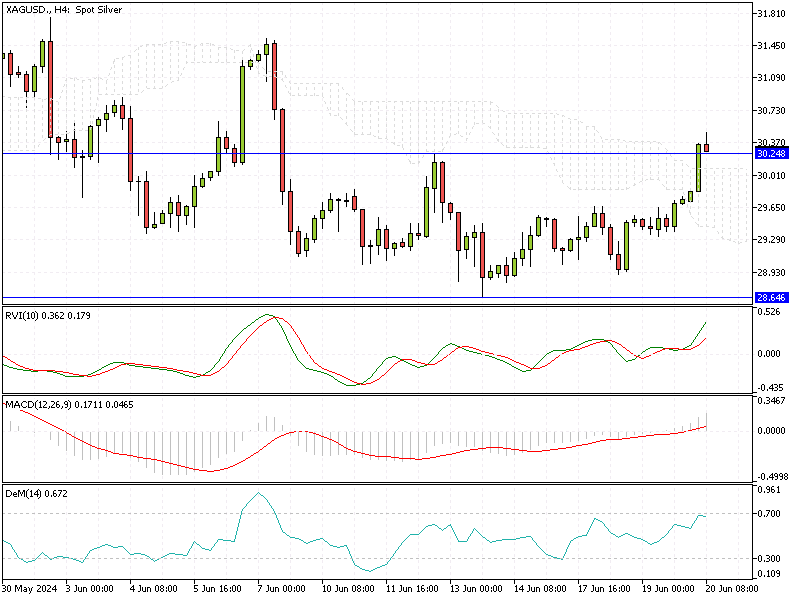

Silver Analysis – 20-June-2024

XAG/USD—Silver prices have surged past $30 per ounce, marking their highest level in nearly two weeks. This rise aligns with the increase in gold prices, fueled by weaker-than-expected U.S. economic data. Investors now believe the Federal Reserve will cut interest rates twice this year. This trend is part of a broader global shift towards monetary easing.

Silver Analysis – 20-June-2024

Silver Analysis – 20-June-2024

The European Central Bank and the Bank of Canada have begun their rate-cutting cycles. Additionally, the Swiss National Bank and the Bank of England are anticipated to follow suit. Central banks in the Asia Pacific region in China, Australia, and New Zealand are also expected to lower their rates this year. On the other hand, Japan might raise rates again in July due to the economic strain caused by a weak yen.

Despite the favorable conditions for precious metals, there are concerns about the slowing industrial demand for metals. In China, industry groups have called for reduced production of solar panels due to overcapacity, which has driven prices down.

This complex economic landscape highlights the importance of staying informed about global monetary policies and industrial trends. Investors should consider these factors when making decisions, as they have significant implications for market dynamics and potential returns.