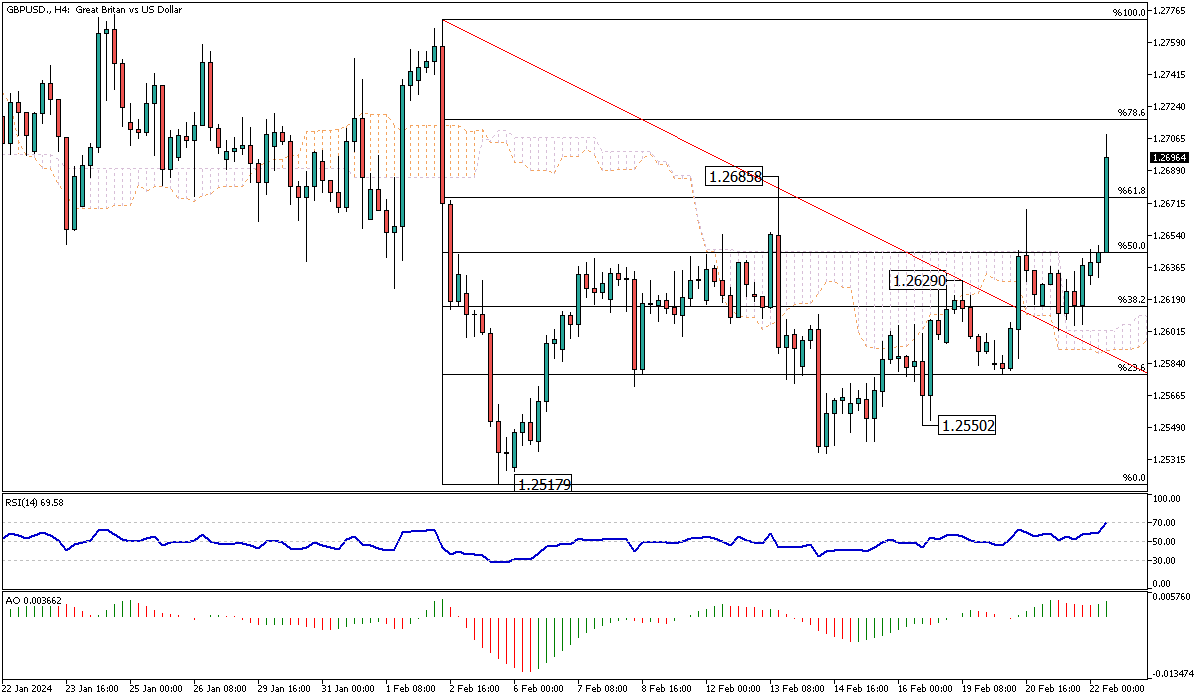

GBPUSD Analysis – February-22-2024

The British Pound has reclaimed its position above the $1.26 mark, reaching its highest value since the beginning of February, driven by the diminishing strength of the US dollar. This upward movement comes as market participants carefully evaluate the less hawkish comments by the Bank of England’s (BoE) officials, assessing their impact on the future direction of the UK’s monetary policy.

The recent statements have led investors to reevaluate their expectations, considering the potential adjustments in interest rates that the evolving economic landscape could influence in the UK.

GBPUSD Analysis: Insights from BoE’s Leadership

Governor Andrew Bailey has recently communicated a nuanced stance, suggesting that the market’s anticipations for potential cuts in interest rates might align with the economic realities despite the British economy showing signs of recovery post-recession. Deputy Governor Ben Broadbent has opened the door to possible rate reductions within the year, depending on the economic developments.

Meanwhile, Swati Dhingra, serving on the Monetary Policy Committee, has pointed out that the UK’s economy faces substantial threats that stringent monetary policies could intensify. These insights are crucial as they shed light on the BoE’s balanced approach towards nurturing the nation’s economic recovery while being prepared to act against inflationary pressures.

Economic Developments and Market Reaction

The UK has witnessed unexpected positive shifts in the economic indicators, with a significant jump in retail sales for January, suggesting a resilient consumer sector. Additionally, the inflation rate has held steady, marginally below the anticipated figures, providing a nuanced view of the nation’s economic health. These developments contribute to the market’s evolving perspective, impacting the Pound’s strength and investor strategies.

The balanced view provided by the BoE officials and the latest economic data offer a complex but hopeful outlook for the UK, influencing investor sentiment and the future monetary policy landscape.