Euro Hits 5-Month High Amid Dollar Weakness

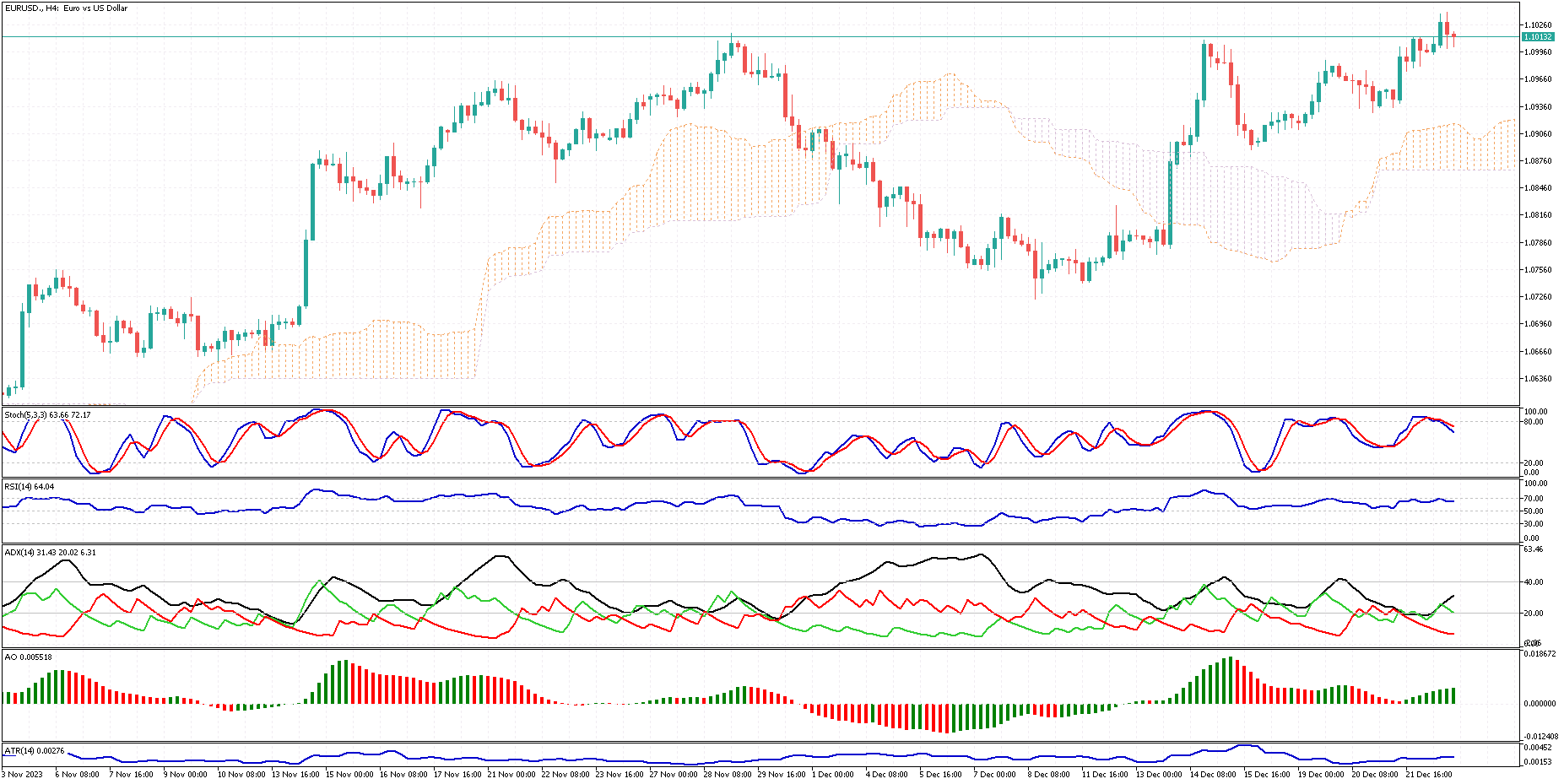

The euro has recently risen to $1.1, marking its highest value in the past five months. This increase is largely due to the weakening of the dollar. The latest PCE inflation data from the US suggests that the Federal Reserve may begin to lower interest rates next year, with the first reduction potentially occurring as early as March.

At the same time, market participants expect the European Central Bank (ECB) to cut borrowing costs next year. This could align with the Fed’s rate cuts, although many policymakers have expressed skepticism about this possibility. Over the course of the year, the euro has appreciated by approximately 3%.