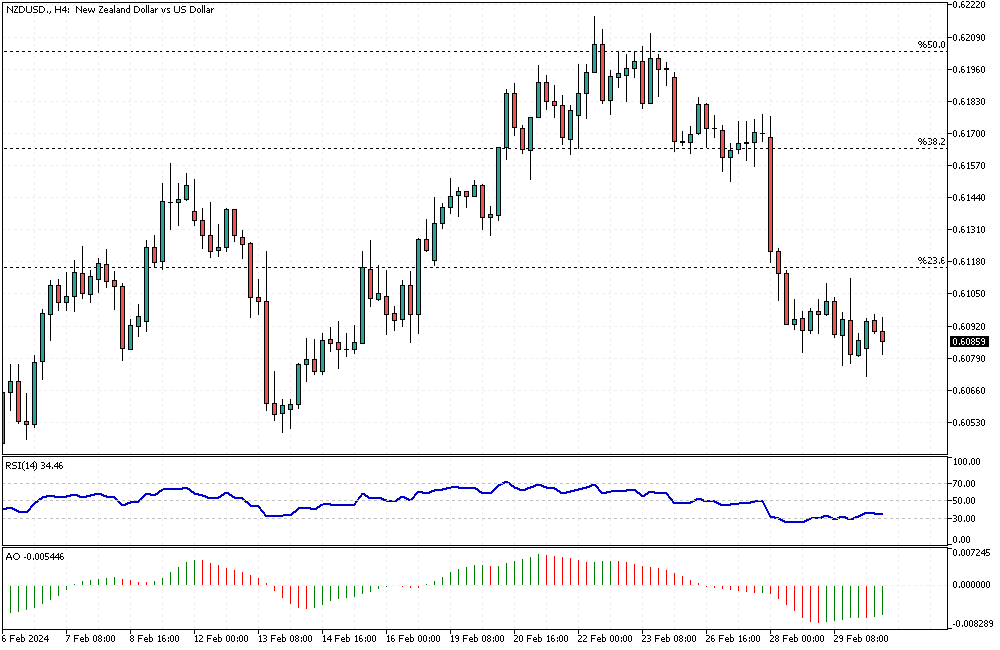

NZDUSD Analysis – March-1-2024

NZDUSD Analysis – The New Zealand dollar fell below the $0.61 mark. This was its lowest in two weeks. The drop came after the Reserve Bank of New Zealand decided to keep interest rates stable. The bank’s stance was less aggressive than what many had predicted. The RBNZ has not changed the cash rate for five consecutive meetings. It remains at 5.5%. This decision aligned with market expectations.

NZDUSD Analysis: RBNZ Adjusts Economic Outlook

The central bank has observed improvements in controlling inflation. It now expects the peak rate to hit 5.6%. Previously, it predicted a peak at 5.7%. This adjustment led investors to scale back their expectations. They now see a mere 20% chance for a rate increase in May. Before the announcement, the likelihood was almost 50%. This significant shift reflects the bank’s evolving economic perspective.

Confidence in Inflation Control

Governor Adrian Orr expressed optimism regarding the economic measures in place. He believes the current official cash rate will curb demand effectively. Orr is confident that inflation will fall within the targeted range of 1% to 3% this year. His confidence reassures markets. Yet, it also leads to adjustments in future interest rate expectations.