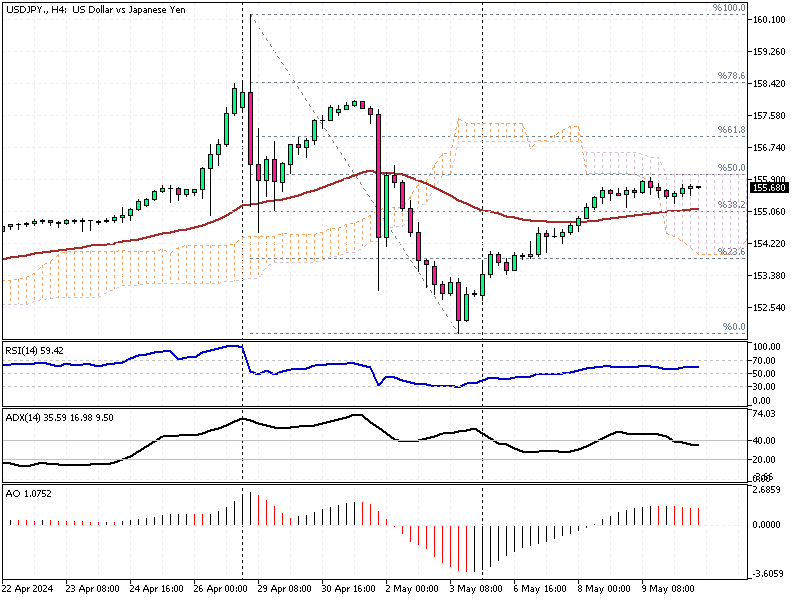

USDJPY Analysis – BoJ Cautious Stance

The Japanese yen stabilized at approximately 155.6, compared to the US dollar (USDJPY), following the release of the Bank of Japan’s (BOJ) April policy meeting summary. During the meeting, the BOJ highlighted potential inflation risks and debated conditions that might necessitate further interest rate hikes.

Additionally, the central bank acknowledged the yen’s depreciation as a significant contributor to rising prices, which has caught its attention.

USDJPY Analysis – BoJ Cautious Stance

Despite these inflationary pressures, the BOJ plans to keep its financial policies accommodative in the near term. This decision comes as they continue to evaluate the economic landscape and the trajectory of price increases. The central bank’s cautious approach balances growth and inflation concerns without making premature policy adjustments.

Economic Indicators and Currency Fluctuations

Recent data indicate that wage growth in Japan slowed down in March, challenging the BOJ’s hopes for a positive cycle of rising wages and prices. Despite these economic indicators, the yen has experienced a nearly 2% decline this week.

However, it had previously rebounded sharply by as much as 5.2% from its low point, likely due to government intervention. Reports suggest that the BOJ intervened in the currency market, spending nearly $60 billion to stabilize the yen.