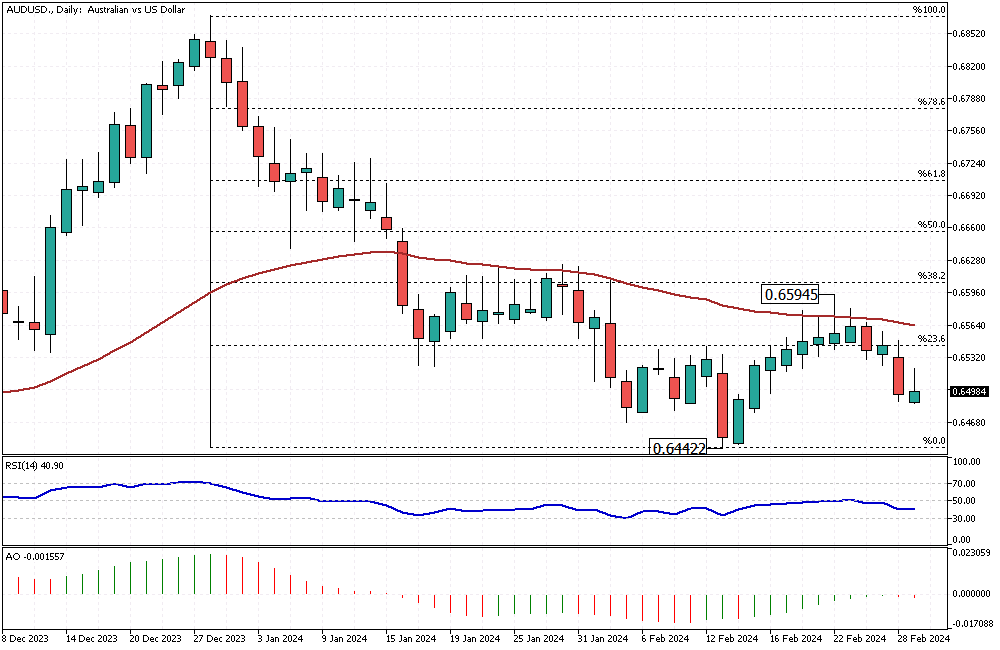

AUDUSD Analysis – February-29-2024

AUDUSD Analysis – The value of the Australian dollar has fallen, reaching levels not seen in the past two weeks. Unexpectedly, low domestic inflation numbers influenced this decline. As indicated by the Consumer Price Index (CPI), the inflation rate remained at a two-year low, stabilizing at 3.4% in January. This figure did not change from December and was below the anticipated 3.6%.

AUDUSD Analysis: Monetary Policy Deliberations

The Reserve Bank of Australia’s (RBA) meeting notes recently revealed a discussion among policymakers. They contemplated whether to increase interest rates during their February session. However, they opted to keep the existing monetary policies unchanged. This decision was based on the emerging evidence of inflation slowing down. Such prudence reflects the RBA’s careful approach to managing economic stability.

Retail Sales and Economic Indicators

Turning to consumer spending, there was a modest rebound in Australian retail sales. After a significant drop of 2.1% in December, sales climbed by 1.1% month-on-month in January. Although this was a positive turn, it fell short of the 1.5% increase that had been projected. This discrepancy between expected and actual sales growth provides insights into consumer confidence and spending behaviors in Australia’s current economic climate.