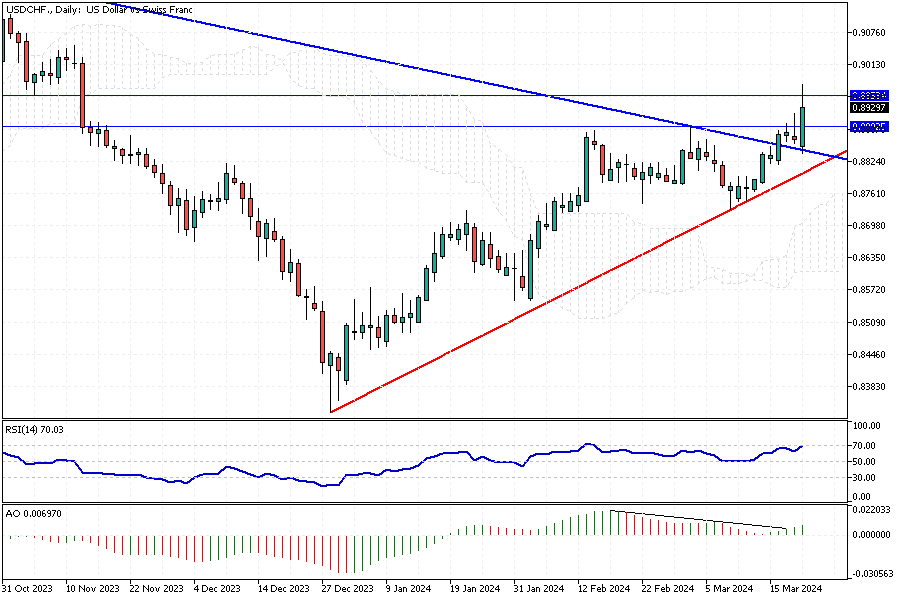

Swiss Franc Surprise Dip Post-SNB Rate Cut

USDCHF Analysis – The Swiss franc took a downturn, falling below the 0.895 mark against the US dollar, hitting its weakest point since November 13. This unexpected shift came after the Swiss National Bank (SNB) decided to lower interest rates unexpectedly – a move not seen in the past nine years.

Unexpected Monetary Policy Shift by SNB

During its March session, the SNB boldly decided to reduce its primary interest rate by 25 basis points, bringing it down to 1.50%. With this action, the SNB stands out as the pioneering major central bank to relax its monetary policy, which is primarily aimed at curbing inflation rates.

Inflation Dynamics and Monetary Strategy

Interestingly, this monetary policy adjustment aligns with a notable decrease in Swiss inflation, which fell to 1.2% in February. This marks the ninth-month inflation rates have stayed within the SNB’s desired target range of 0-2%. This change indicates a strategic move by the bank to address economic conditions while maintaining inflation control.

By adjusting its policies in response to shifting economic indicators, the SNB demonstrates a proactive approach to maintaining financial stability and supporting the Swiss economy’s health. This also provides an insightful case study on the impacts of central banking decisions on currency value and inflation trends.