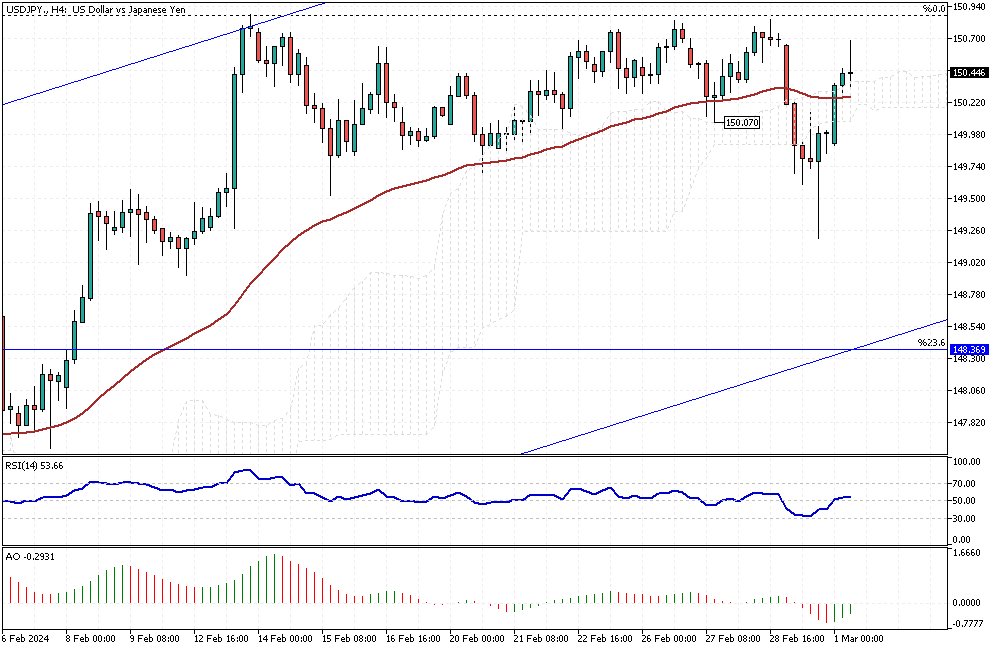

USDJPY Analysis – March-1-2024

USDJPY Analysis – The value of the Japanese yen has fallen beyond 150 against the US dollar. This drop has reversed the recent improvements. The decline followed statements from Bank of Japan Governor Kazuo Ueda. He indicated it is premature to expect the central bank’s 2% inflation target to be consistently met.

Ueda emphasized the importance of examining further data—especially related to wages before making any decisions. The need to observe the emergence and growth of a beneficial wage and inflation cycle was highlighted.

Bank of Japan’s Cautious Stance on Policy Change

Governor Ueda’s cautious remarks contrast with those of BOJ board member Hajime Takata. Takata had previously suggested that the bank should start planning the end of its highly lenient monetary policy. He specifically mentioned moving away from negative interest rates and controlling bond yields. These differing viewpoints within the Bank of Japan underscore a significant moment of contemplation.

The bank is weighing the timing and strategy for shifting away from its current economic support measures.

USDJPY Analysis: Market Reactions and Future BOJ Directions

The Japanese yen has been notably weak throughout the year. This is mainly due to the Bank of Japan’s persistent easy-money policies. These policies starkly contrast to the tighter monetary strategies of other central global banks. Investors and market analysts closely monitor these developments. They seek to understand how Japan’s monetary policy landscape might evolve.

The balance between stimulating economic growth and controlling inflation is a delicate one. The BOJ’s future decisions will be critical in shaping Japan’s economic trajectory.