Gold Analysis – Inflation Concerns and Fed Policy

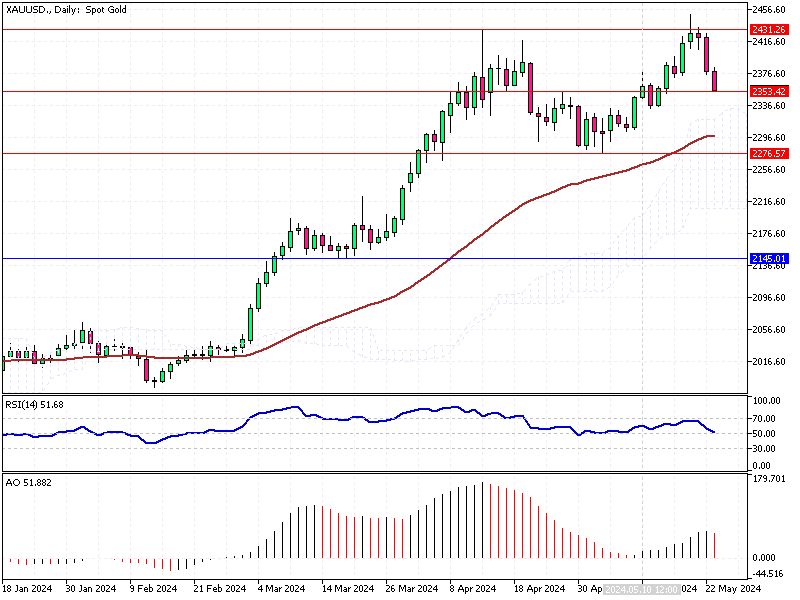

Gold prices fell to around $2,360 per ounce on Thursday. This decline comes as investors adjust their expectations for interest rate cuts following hawkish signals from the Federal Reserve.

Gold Analysis – Inflation Concerns and Fed Policy

Minutes from the latest Fed meeting revealed that policymakers generally feel it will take longer than expected to be confident that inflation is moving towards the 2% target. Some officials even suggested that if price growth continues, raising interest rates might be necessary.

Impact on Gold Prices

The Fed’s cautious stance has reinforced recent comments from officials advocating for policy caution. Despite the latest data indicating an easing of US inflation, the possibility of higher rates remains. Higher interest rates decrease the appeal of gold, which doesn’t yield interest.

Gold as an Inflation Hedge

However, with rising price pressures, gold remains an attractive hedge against inflation. Investors often turn to gold during times of inflation as it retains value better than some other investments.

Making Informed Decisions

In conclusion, the current economic data suggest a cautious approach to gold investments. While higher rates might deter some investors, others might find gold appealing as a hedge against inflation. Staying informed about Fed policies and inflation trends is crucial for making wise investment decisions.