EIA Data – Crude Inventories Rise Unexpectedly

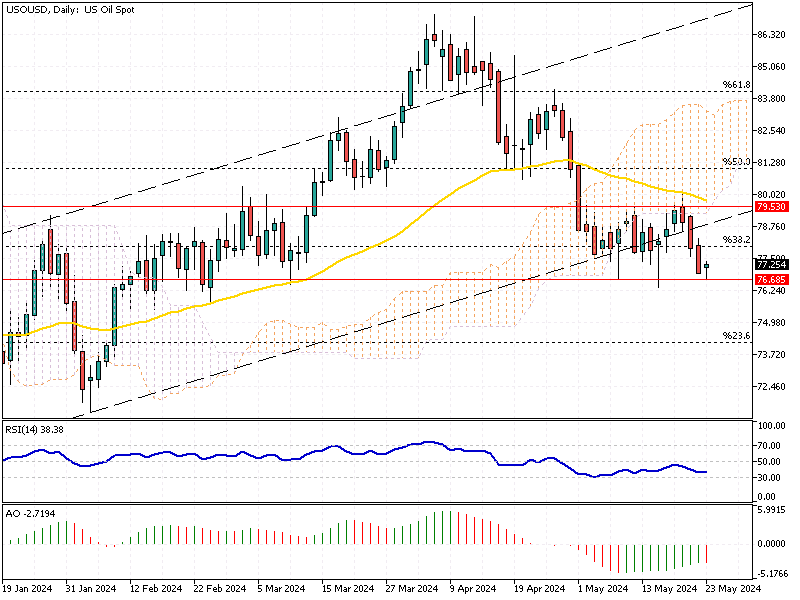

WTI crude futures fell below $77 per barrel on Thursday, marking the fourth consecutive decline. This drop comes as the latest Federal Reserve minutes indicate that members are open to tightening policy further if inflation spikes. This potential tightening could harm energy demand in the United States, the world’s top oil consumer.

EIA Data – Crude Inventories Rise Unexpectedly

Adding to the bearish sentiment, the Energy Information Administration (EIA) reported an unexpected increase in US crude inventories. Last week, crude stocks rose by 1.825 million barrels, while the market had anticipated a 2.55 million barrel decrease. Additionally, US distillate stocks increased, and gasoline stocks fell less than expected, adding to the complexity of the market outlook.

Russia Exceeds OPEC+ Production Quota

In other news, Russia announced on Wednesday that it had exceeded its OPEC+ production quota in April due to technical reasons. This breach has prompted Russia to propose a plan to rectify the situation. This significant development affects global oil supply dynamics and market expectations.

Anticipation Builds for OPEC+ Meeting

All eyes are now on the upcoming OPEC+ meeting scheduled for June 1. Key oil producers are expected to extend output cuts to prevent a global oversupply and support prices. This meeting will be crucial for traders as decisions made here could significantly influence oil market trends and prices in the coming months.

Making Informed Trading Decisions

For forex traders and investors, staying updated on these developments is vital. The interplay between Federal Reserve policies, EIA data, and OPEC+ decisions creates a complex but navigable landscape. By understanding these factors, traders can make more informed decisions, anticipate market movements, and optimize their trading strategies.

Stay informed, stay ahead, and make smarter trading decisions in this dynamic market environment.