Yuan Falls Near One-Month Low Due to U.S. Data

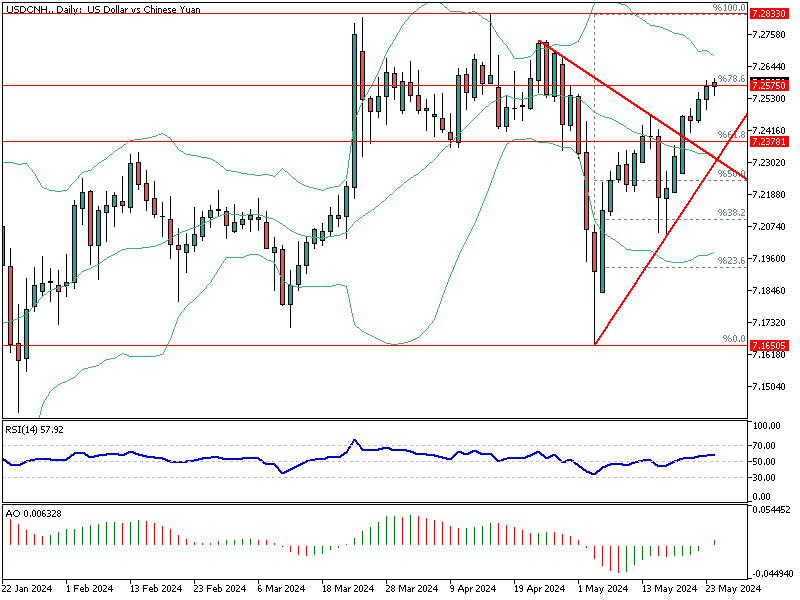

USD/CNH—The offshore yuan has edged lower to around $7.259, nearing a one-month low. This decline is influenced by strong U.S. economic indicators released overnight, indicating the potential for prolonged higher interest rates.

Yuan Falls Near One-Month Low Due to U.S. Data

Recent U.S. economic data has shown a significant boost in business activity. S&P figures revealed that U.S. business activity surged to its highest level in over two years this May. Additionally, weekly jobless claims fell more than expected, highlighting the underlying strength in the U.S. labor market.

Compounding the yuan’s weakness is escalating geopolitical tensions in the Taiwan Strait. China has conducted consecutive military exercises around Taiwan, displaying its ability to control strategic areas. These actions are framed as a response to Taiwan’s President, Lai Ching-te.

Implications for Forex Traders

These developments suggest a need for caution for forex traders. The strong U.S. economic data points to potential interest rate hikes, which can further influence currency movements. Additionally, geopolitical tensions may lead to increased market volatility.