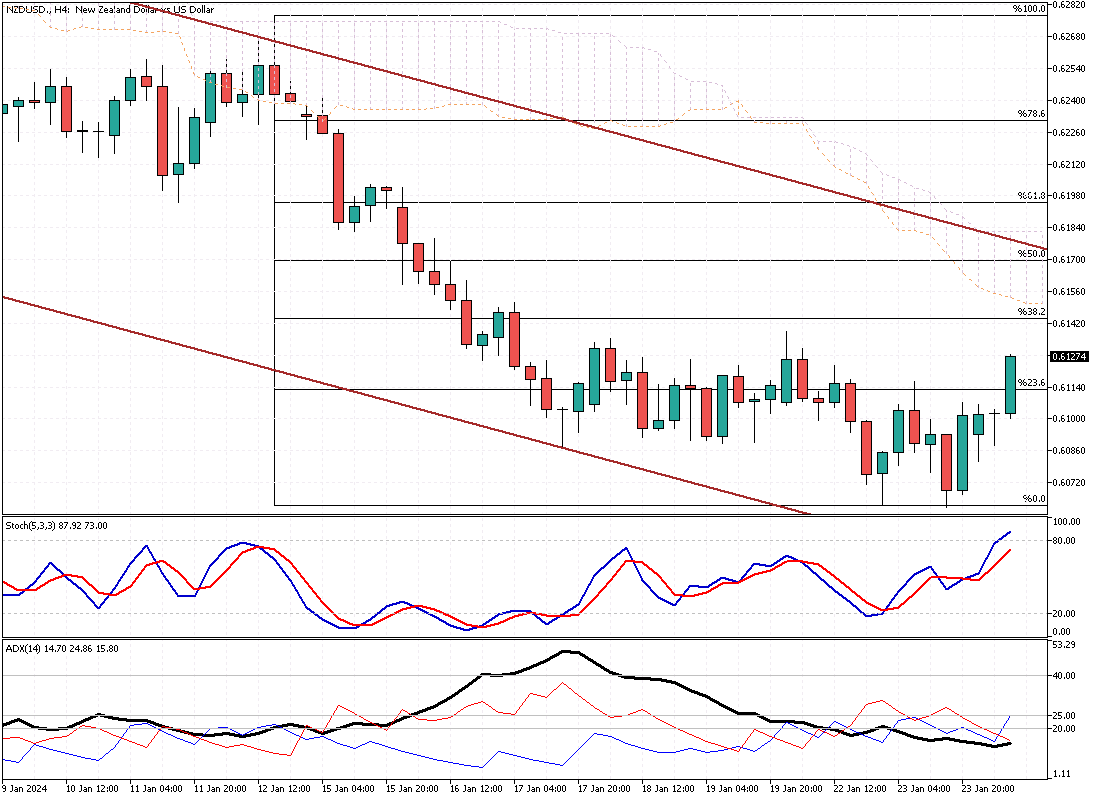

NZDUSD Analysis – January-24-2024

The New Zealand dollar exhibited stability, hovering around the $0.61 mark, as the market reacted calmly to the latest fourth-quarter inflation report from New Zealand. This report brought forth a few surprises, with the country’s consumer price index showing a 0.5% increase on a quarter-on-quarter basis for the three months leading up to December. This slowdown was widely anticipated compared to the 1.8% gain in the third quarter. Moreover, the annual inflation rate also decelerated, reaching 4.7% in the fourth quarter, down from 5.6% in the preceding quarter, marking the lowest rate observed since mid-2021.

Anticipation Builds for Bank of New Zealand Chief Economist’s Speech

Investors eagerly anticipate an upcoming speech by Paul Conway, Chief Economist at the Reserve Bank of New Zealand. Conway’s speech, scheduled for later this month, is expected to address and potentially counteract dovish market sentiments. The New Zealand dollar, also known as the Kiwi, has been experiencing downward pressure due to the strength of the US dollar. This can be attributed to traders revising their expectations for early interest rate cuts by the Federal Reserve within the year. Conway’s insights and remarks hold significance for the currency’s future performance.

Factors Influencing New Zealand Dollar’s Outlook

The performance of the New Zealand dollar is influenced by a confluence of factors, including domestic and international dynamics. While in line with expectations, the recent slowdown in inflation underscores the Reserve Bank of New Zealand’s potential policy response in the coming months. The central bank may reconsider its stance on interest rates and monetary policy as inflation eases. Additionally, the global context plays a crucial role, with the strength of the US dollar impacting the Kiwi’s performance. Traders’ expectations regarding the Federal Reserve’s actions will continue to shape the New Zealand dollar’s trajectory, making it imperative to closely monitor domestic economic indicators and international market trends to gauge the currency’s future direction.