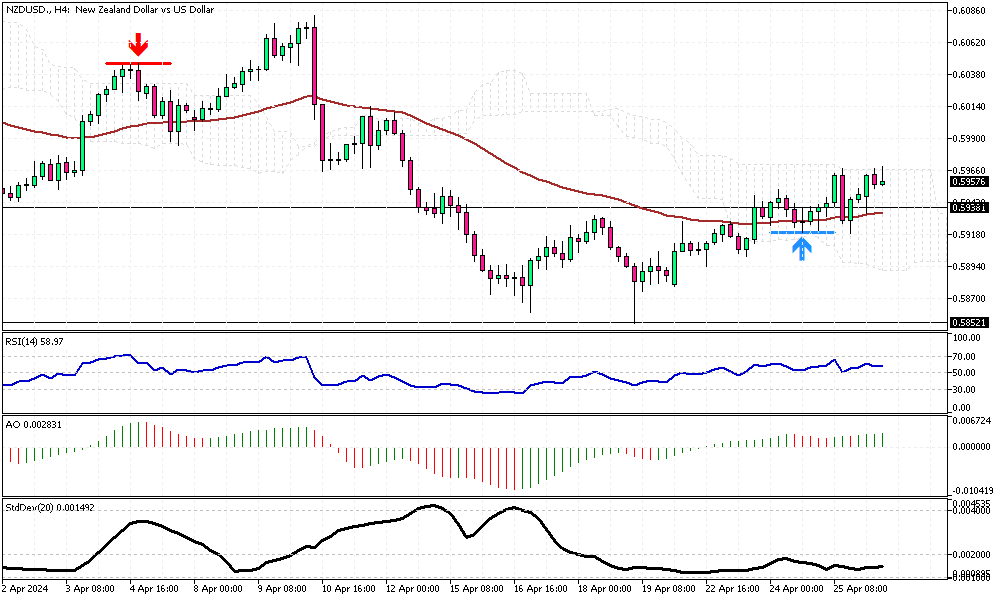

NZDUSD Analysis: Kiwi Dollar Rises Amid Yen Sell-Off

NZDUSD Analysis – The New Zealand dollar, commonly called the Kiwi, experienced an upward trajectory, trading above $0.595. This movement was primarily propelled by a widespread sell-off of the Japanese yen, which occurred after the Bank of Japan’s decision to maintain steady interest rates—a move anticipated by market analysts.

Despite this positive trend, the Kiwi’s gains were somewhat curtailed later in the day. This reduction in momentum can be attributed to a resurgence in the value of the US dollar, sparked by newly released economic data from the United States.

U.S. Economic Data Influence

The US economy reported its slowest growth rate in almost two years during the year’s first quarter. This slowdown was contrasted by a rise in inflation rates, prompting speculation among investors and market observers that the Federal Reserve might prolong its restrictive monetary policies.

Such policies typically aim to control inflation by keeping interest rates higher, potentially dampening economic growth. As the day progressed, market participants eagerly awaited the release of the PCE price index report. This report is particularly significant as it serves as the Federal Reserve’s preferred measure of inflation, offering critical insights into future monetary policy directions.

New Zealand’s Economic Stance

In New Zealand, the Reserve Bank of New Zealand (RBNZ) has maintained its official cash rate at 5.5% for the current month. This decision underscores the central bank’s commitment to maintaining a restrictive monetary policy over an extended period. The goal is to guide inflation back within the 1-3% target range.

Notably, the country’s annual inflation rate cooled to 4% in the first quarter of 2024, marking the lowest rate since the second quarter of 2021. This indicates a potential easing of inflationary pressures, although the central bank remains cautious in its approach towards achieving long-term economic stability.