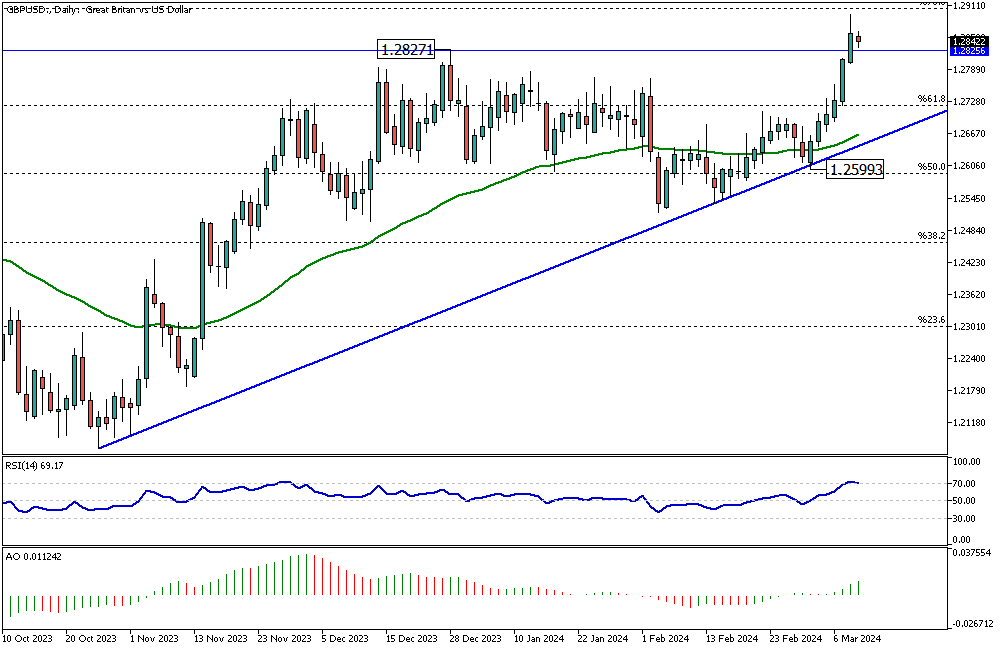

GBPUSD Analysis – March-11-2024

GBPUSD Analysis – The British pound has been rising, nearing the $1.29 level, marking its best performance since July 26th. This surge is primarily due to the weakening US dollar and positive outlooks on the British economy. Recent reports from last Friday indicate an increase in unemployment rates and a deceleration in salary increases.

This situation has led to the anticipation that the US Federal Reserve may lower interest rates by the middle of this year. Jerome Powell, the Fed Chair, suggested that the Fed is close to being confident enough in the direction of inflation to think about reducing interest rates.

Anticipations for Monetary Policy Adjustments

While the US hints at possible rate cuts, the UK’s approach seems different. The Bank of England appears to be taking a more cautious stance, expecting to postpone any interest rate reductions until August. This careful approach contrasts with the immediate economic strategies adopted in the US.

The differing timelines and economic strategies of these two major economies highlight the complexity of the global economic landscape and how central banks navigate uncertain times.

GBPUSD Analysis: UK Economic Strategy

In other news, UK Finance Minister Jeremy Hunt has announced significant changes in the spring budget, focusing on long-term tax reductions. These fiscal adjustments are set to foster a more conducive environment for economic growth and stability.

Additionally, the latest forecasts by the Office for Budget Responsibility (OBR) project a quicker reduction in inflation rates and a more robust expansion of the Gross Domestic Product (GDP) for 2024 and 2025. These optimistic projections contribute to the positive sentiment surrounding the UK economy and the strength of the British pound.