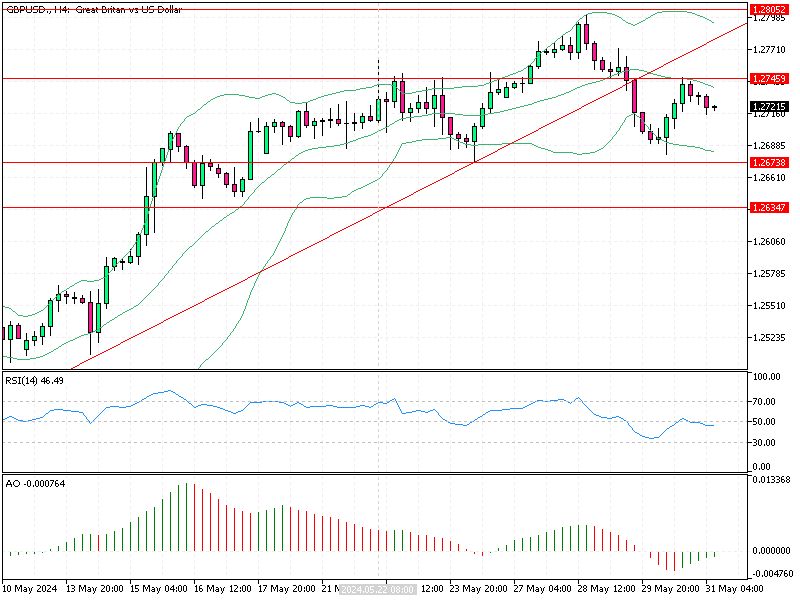

GBPUSD Analysis – 31-May-2024

The British pound has recently edged below the $1.275 (GBP/USD) mark, retreating from its two-month high of $1.28 reached on May 27th. This pullback is influenced by renewed support for the US dollar despite strong momentum for the pound driven by the Bank of England’s (BoE) hawkish stance.

GBPUSD Analysis – 31-May-2024

Federal Reserve members have indicated that interest rate cuts in the US will only occur after several months of lower inflation, reinforcing the dollar’s strength. However, the BoE’s delayed rate cut bets have limited the pound’s decline.

The annual inflation rate in the UK has eased to 2.3%, nearing the BoE’s target of 2% but still above the forecasted 2.1%. Investors now expect the BoE’s first rate cut to occur in September rather than the previously anticipated June. This change in expectations was influenced by Prime Minister Rishi Sunak’s unexpected announcement of a general election in early July.

While the BoE emphasizes its independence, past accusations of political interference have made markets more comfortable with the idea of a rate cut in September. This shift highlights the complex interplay between economic indicators and political events in shaping market expectations.

Understanding these dynamics is crucial for making informed decisions in the current economic climate. Monitor inflation trends and central bank announcements to effectively navigate the evolving market landscape.