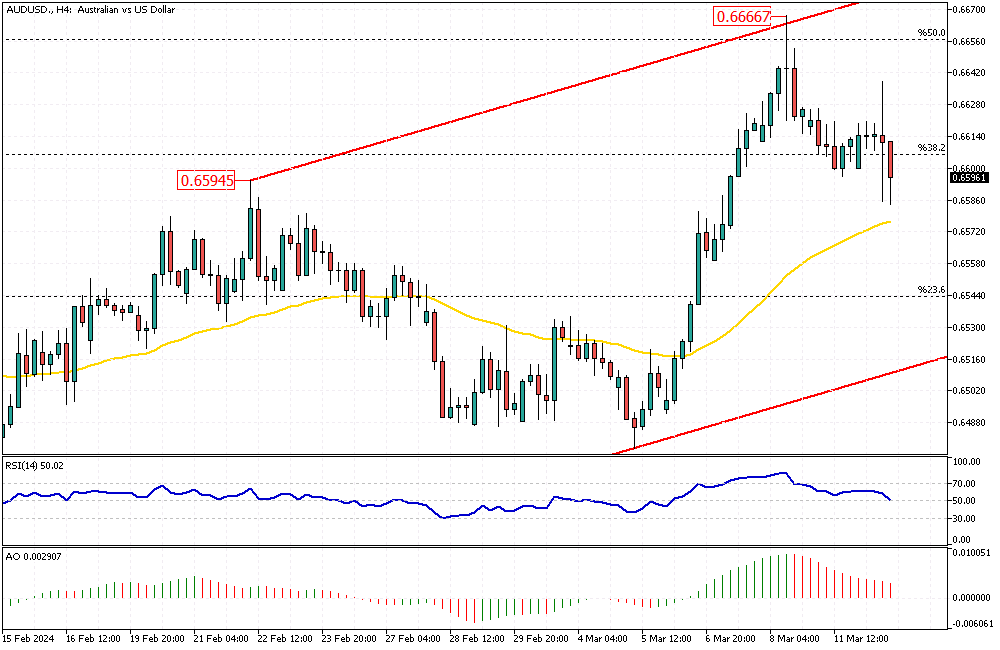

AUDUSD Analysis – March-12-2024

AUDUSD Analysis – The Australian dollar has significantly risen, crossing the $0.659 mark for the first time in over seven weeks. This increase comes amid speculations that the US Federal Reserve might reduce interest rates sooner than other leading global banks.

Federal Reserve Chair Powell hinted during his US Senate testimony that the central bank might ease up on its tough policies if the decrease in inflation continues. This statement has fueled the Australian dollar’s surge.

AUDUSD Analysis: Economic Growth Down Under

Australia’s economic growth was not as strong as anticipated in the last quarter of the year. This slower growth suggests that the Reserve Bank of Australia (RBA) might lower interest rates sooner than expected.

Market predictions now suggest almost a 90% likelihood that the RBA will cut its cash rate by August. This move stimulates growth by making borrowing cheaper and encouraging spending and investment.

Interest Rate Expectations in Australia

Following recent economic reports, Australia’s expectations for interest rate cuts have intensified. The Commonwealth Bank of Australia, a significant bank, predicts a total reduction of 75 basis points in interest rates this year, higher than the market forecast of 45 basis points.

This adjustment comes after Australia’s weaker-than-expected Gross Domestic Product (GDP) data, which has led to a shift in economic strategies. Lowering interest rates could help boost economic activity by making it less expensive for people and businesses to borrow money, thus encouraging spending and investment.