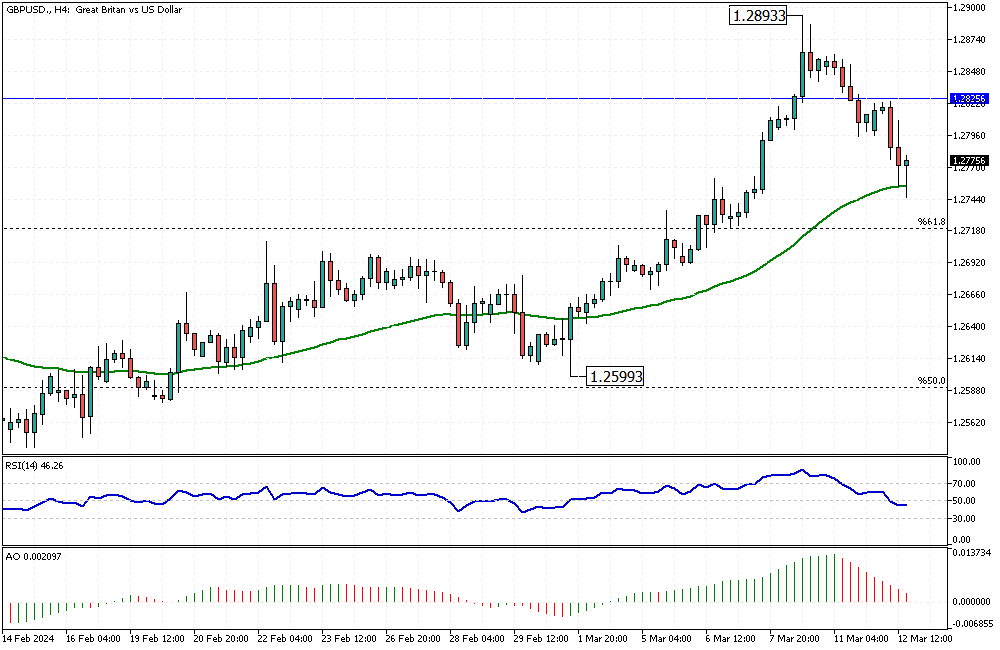

GBPUSD Analysis – March-12-2024

GBPUSD Analysis – The British pound is falling. It went below $1.28, lower than the high of $1.289 seen last week. This change happened after the US shared its latest inflation numbers. Also, there are signs that fewer people are getting jobs in the UK. The UK’s money is worth less than that of other countries.

Changes in UK Employment and Wages

In the UK, the pay rate (excluding additional bonuses) has increased by 6.1% from the previous year. However, this is the smallest increment since October 2022, falling short of the 6.2% projected by experts.

More alarmingly, the number of unemployed individuals has risen, with a 3.9% unemployment rate, surpassing the anticipated 3.8%. The number of available job opportunities is also declining, a trend that has persisted for some time now.

What’s Next for Interest Rates?

The Future of Interest Rates: Uncertainty Looms Financial traders are closely monitoring the banks, anticipating a potential interest rate reduction by the Bank of England in August. This projection is based on the current state of the economy.

However, the European Central Bank and the Federal Reserve in the US might act even sooner, potentially lowering their rates by June. This development is crucial as it directly impacts the cost of borrowing, necessitating a heightened state of preparedness.