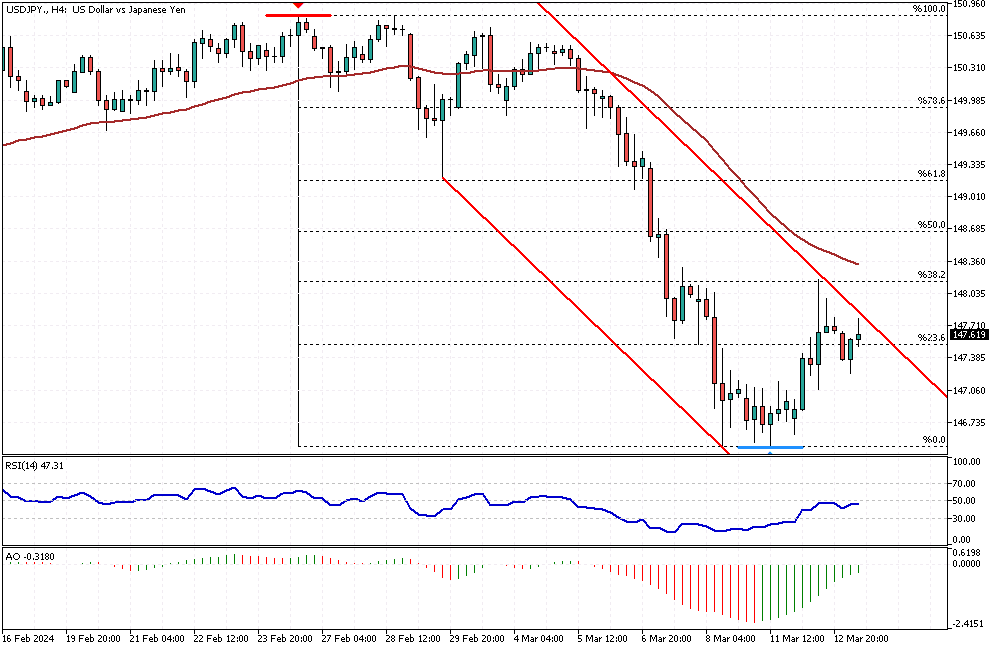

USDJPY Analysis – March-13-2024

USDJPY Analysis – The Japanese yen maintains a stable position, hovering around 147.5 against the dollar. Despite Governor Kazuo Ueda’s slightly more pessimistic view of the country’s economic situation, this steady state provides a sense of security. He told the parliament that Japan is gradually recovering despite signs of struggle in some economic regions.

The nation’s currency status is crucial for traders and investors. It offers a stable basis for their decisions as they closely monitor Japan’s financial health and policy directions.

Insights into Japan’s Economic Health and Monetary Policy

Japan’s Economic Resilience and Future Prospects

Recent statistics reveal a significant turn of events for Japan’s economy. It has managed to dodge a technical recession by returning to growth in the last quarter of 2023. This resilience, highlighted by the country’s capacity to rebound from economic downturns, inspires confidence in its prospects.

Such growth indicators are vital, providing a glimpse into the nation’s financial stability and future growth potential. As discussions and speculations continue, all eyes are on the Bank of Japan’s upcoming policy meeting, which may set the tone for the country’s economic direction in the coming months, further bolstering this confidence.