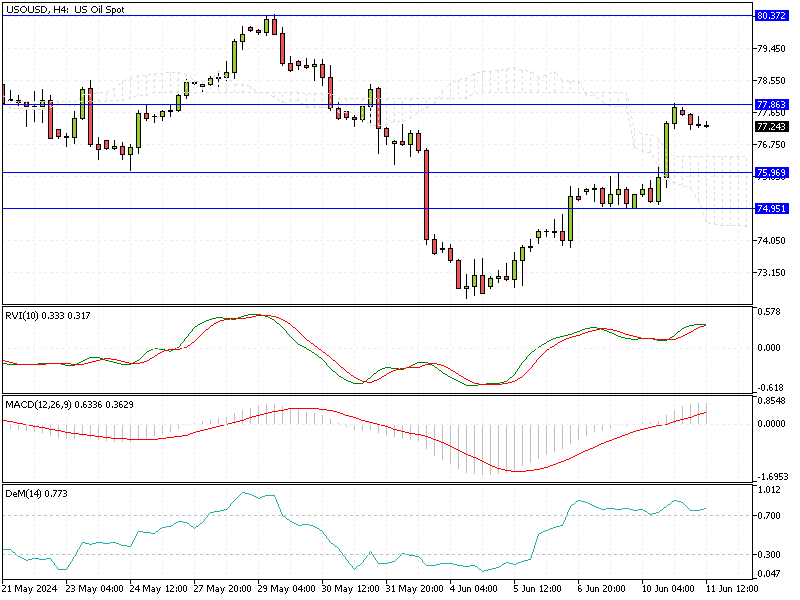

WTI Crude Oil Analysis – 11-June-2024

WTI crude oil futures held near $78 per barrel on Tuesday, maintaining gains from a nearly 3% rise in the previous session. This surge is driven by expectations of increased fuel demand as summer approaches.

Additionally, the US government plans to replenish the Strategic Petroleum Reserve (SPR) more quickly, aiming to purchase oil at around $79 per barrel, which supports current price levels.

WTI Crude Oil Analysis – 11-June-2024

Investors Brace for Key Market Updates

Investors are approaching the market with caution due to several significant upcoming events. The Federal Reserve is set to announce its latest policy decision, and a critical US inflation report is also expected this week.

These developments follow strong US jobs data released last Friday, which has heightened concerns that the Federal Reserve may keep interest rates elevated for a longer period. Such a scenario could dampen economic growth and reduce energy demand.

US Crude Inventory Data Anticipation

Market participants eagerly await US crude inventory data from the American Petroleum Institute (API) on Tuesday and the Energy Information Administration (EIA) on Wednesday, as these reports will provide further insights into oil market fundamentals.

EIA, OPEC, IEA Reports to Impact Markets

Monthly market reports from the EIA, the Organization of the Petroleum Exporting Countries (OPEC), and the International Energy Agency (IEA) are due this week, which could influence market dynamics.

This data is crucial for making informed decisions in the oil market, as it helps traders and investors understand supply and demand trends, potential price movements, and broader economic impacts.