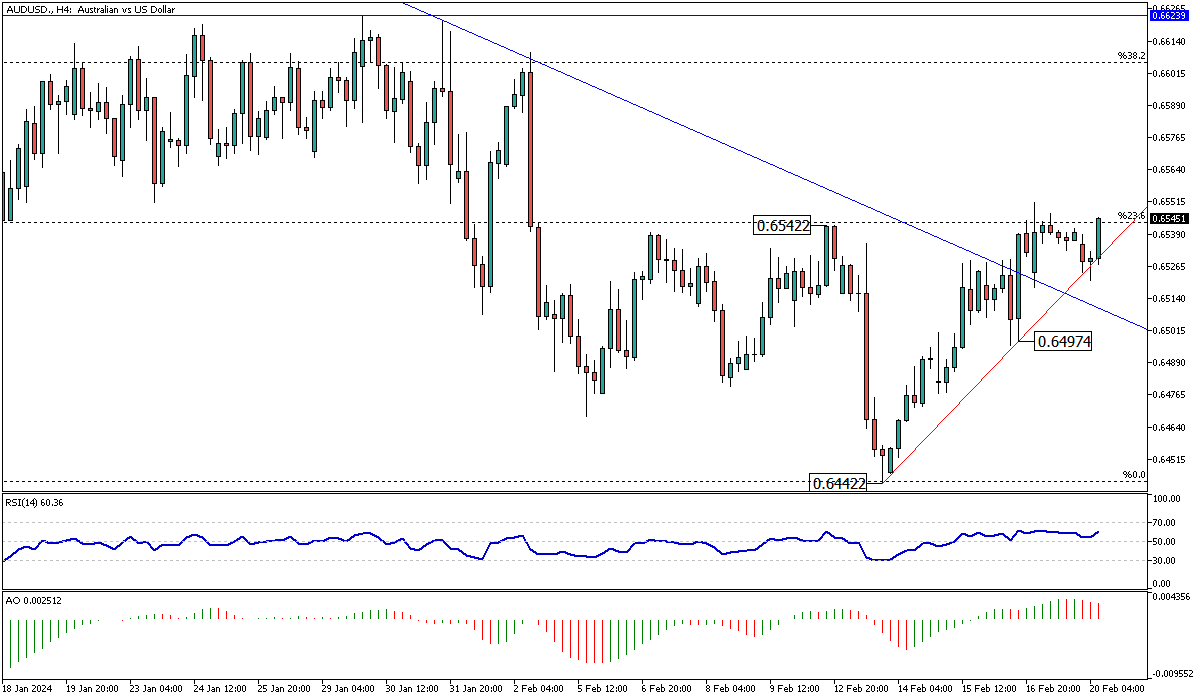

AUDUSD Analysis – February-20-2024

AUDUSD – The Australian dollar has recently experienced a decline, dropping to approximately $0.652, stepping back from its position at two-week highs. This movement reflects market reactions to the latest minutes from the Reserve Bank of Australia (RBA). During their February policy meeting, RBA officials engaged in discussions regarding potential increases in interest rates. However, they chose to keep the rates unchanged, influenced by the initial signs of slowing inflation.

This cautious approach underscores the central bank’s strategy to wait for more concrete evidence that inflation rates steadily return to the desired target range before considering any adjustments to the current monetary policy.

AUDUSD Analysis: Reserve Bank’s Stance on Monetary Policy

In recent deliberations, the RBA has taken a cautious but open-minded approach towards adjusting the monetary settings. The central bank is on a tightrope, balancing between the need to control inflation and the imperative to support economic growth. Market analysts expect that the RBA might implement interest rate reductions totaling around 40 basis points throughout the current year, anticipating the initial rate cut happening in August.

This perspective comes in the wake of statements from RBA Governor Michele Bullock, who clarified that achieving an inflation rate of 2.5% is not a prerequisite for the central bank to start considering a reduction in the cash rate. However, Governor Bullock also highlighted that the RBA has not closed the door on the possibility of future rate hikes if inflation remains stubbornly high, indicating a flexible yet vigilant approach to monetary policy.

Market Anticipation and Economic Outlook

Investors and market analysts are closely monitoring the RBA’s moves, as the interplay between interest rates and inflation carries significant implications for the Australian economy and the value of its currency. The central bank’s current stance, awaiting more substantial evidence of inflation moderation, reflects a broader global challenge of managing post-pandemic economic recovery amidst varying inflationary pressures. As the RBA treads cautiously, its decisions will remain a focal point for financial forecasts and currency valuations.

The nuanced approach of the RBA, balancing between not rushing into interest rate cuts while remaining open to further rate increases, underscores the complex economic landscape that central banks worldwide are navigating. This situation presents challenges and opportunities for investors as they adjust their strategies in response to the evolving economic indicators and significant bank policies.