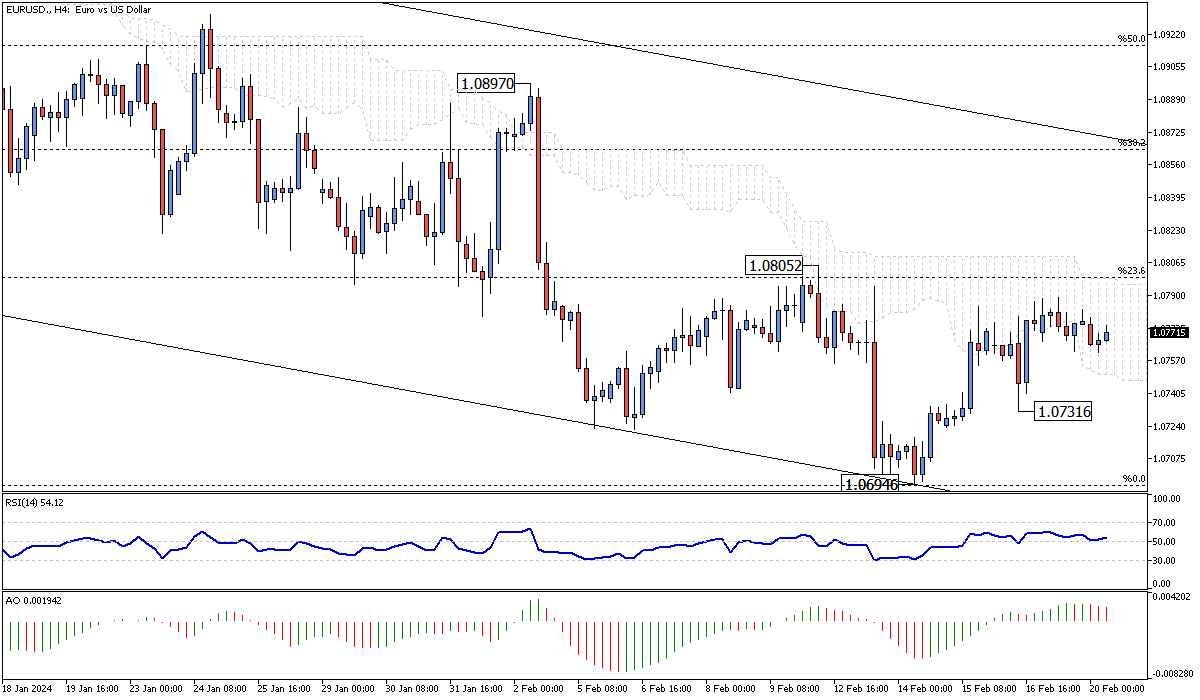

EURUSD Analysis – February-20-2024

EURUSD – The euro has maintained its position slightly above the $1.075 threshold, recovering from a recent drop to a three-month nadir of $1.0693 on February 14th. This rebound is happening against a backdrop of investor analysis of the cautious tones struck by various officials from the European Central Bank concerning the easing of monetary policy.

ECB President Christine Lagarde highlighted last Thursday that although the data from European nations indicate a slow convergence of inflation to the target rates, a solid assessment, especially in terms of wage growth, is necessary before the central bank can contemplate any reduction in interest rates. This stance introduces a layer of caution among investors, reflecting the complex dynamics between economic recovery indicators and monetary policy adjustments.

EURUSD Analysis: ECB’s Cautious Stance on Interest Rates

In a similar vein, ECB policymaker Pablo Hernandez de Cos projected a cautious outlook toward the reduction of interest rates, leaving the market in a state of anticipation regarding the timing of such actions. This careful approach by the ECB officials underscores the delicate balance central banks are attempting to maintain in navigating towards economic stability without precipitating any adverse effects from premature policy shifts.

The emphasis on needing more conclusive evidence, mainly related to wages, before making rate adjustments highlights the ECB’s systematic approach to ensuring that inflation targets are met sustainably and without triggering unintended economic repercussions.

Global Economic Indicators and Market Sentiments

On the other side of the Atlantic, investors are juxtaposing the tepid US retail sales data against strong inflation figures to speculate on the Federal Reserve’s next moves regarding interest rates. This comparison is crucial as it offers insights into consumer confidence and spending behavior, which are significant indicators of economic health.

The mixed signals from the US economy add another layer of complexity to the global financial landscape, influencing investor strategies and market sentiments. As markets worldwide react to these intertwined economic signals, major central banks’ anticipation of policy shifts continues to play a pivotal role in shaping the short-term financial outlook and investor strategies.